CPA Licensing Requirements

Updated March 5, 2025

The CPA Exam

A new version of the CPA exam launched on Jan. 1, 2024. The new exam includes three core sections, plus one discipline section that the candidate may choose. Changes in the schedule for exam test windows and score release will also occur initially as the exam is rolled out.

- Download this summary

- CPA Exam Section Details

- The Big Picture - Find out how the CPA Exam is evolving to meet marketplace demands.

- FAQs about the CPA Exam

2025 Core section administration and score release schedule:

The Core sections are available with continuous testing in 2025.

If the AICPA receives | Your target score |

|---|---|

January 23 | February 7 |

February 14 | February 25 |

March 9 | March 18 |

March 31 | April 9 |

April 23 | May 8 |

May 16 | May 28 |

June 8 | June 17 |

June 30 | July 10 |

July 23 | August 7 |

August 15 | August 26 |

September 7 | September 16 |

September 30 | October 9 |

October 23 | November 7 |

November 15 | November 25 |

December 8 | December 16 |

December 31 | January 13 |

* Please note: Exam data files received after this date will be included in the next scheduled score release.

2025 Discipline section administration and score release schedule:

The Discipline sections will be administered in the first month of each quarter in 2025*.

Testing Dates | Your target score release date is: |

|---|---|

January 1 - 31 | March 14 |

April 1 - 30 | May 16 |

July 1 - 31 | September 11 |

October 1 - 31 | December 16 |

* For the second quarter of 2025 only, we were able to adjust the testing dates and score release dates to accommodate the credit extensions through June 30, 2025.

CPA Exam Eligibility

Effective September 1, 2023 , Texas CPA Exam candidates become eligible to begin testing at 120 hours of education credit, including 21 hours of upper-level accounting.

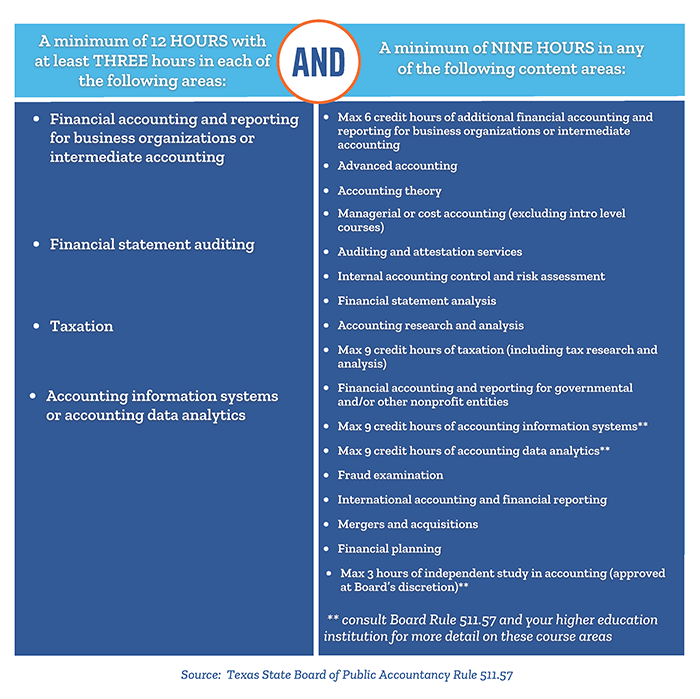

The upper-level accounting requirements can be fulfilled as follows:

Other Updates and Opportunities for Texas Students and Candidates:

- Notice to Schedule in Texas extended from 90 days to 180 days, effective Jan. 1, 2024

- Expiration of exam credits were also extended from 18 months to 30 months, effective Jan. 1, 2024

- The Applicant Reassessment Program from the Texas State Board of Public Accountancy invites those who lost exam credits between Jan. 1, 2020, and Jan. 1, 2024, due to expiration to reach out for potential reinstatement of those credits.

- The Texas State Board of Public Accountancy also announces expanded eligibility for their Accounting Student Scholarship Program.

Helpful Links

- TXCPA Student and Candidate Membership Options | Become a Member

- TXCPA Resources for Students and Candidates | Become a Texas CPA

- Texas State Board of Public Accountancy | TSBPA website

- National Association of State Boards of Accountancy | Obtaining a CPA License

- CPA Exam | Everything you need to know about the CPA Exam

- American Institute of CPAs | This Way to CPA Website

- Find out when you’ll get your CPA Exam score