Post de-SPAC Stock Compensation Awards

By Josef Rashty

Stock compensation awards come in many different forms – incentive stock options (ISOs), non-qualified stock options (NQSOs), restricted stock units (RSUs), stock appreciation rights (SARs), employee stock purchase plans (ESPPs) and warrants. Companies often grant stock awards to their employees or other related parties in lieu of monetary compensation, and they classify them either as equity or liability, depending on characteristics of awards, and reflect the corresponding amount as capitalized assets or compensation costs.

In the September/October 2021 issue of Today’s CPA, TXCPA published an article titled “Accounting for De-SPAC Transactions.” This article is an addendum to the aforementioned published article and explicates accounting implications of stock compensation awards in the post de-SPAC period, based on ASC 718, Compensation–Stock Compensation.

The objective of this article is not to provide a comprehensive background on stock compensation awards accounting, but to investigate some of the issues that post de-SPAC companies may encounter with their legacy and newly granted stock awards. Nevertheless, post de-SPAC companies deal with more or less the same accounting issues as traditional post IPO companies.

Exhibit 1 defines some of the terminologies that this article has used.

Exhibit 1 - Definition of Terminologies

SPAC - is a newly formed public business entity (PBD) that is created with some capital contribution from its initial investors. SPACs raise additional funds as they go through IPOs and finally, they use their financial resources (cash from IPO or equity from initial investors and often both) to acquire a target company.

Target - is usually a private emergin company that acquiesces to a merger with a SPAC.

de-SPAC - is the merger process of a SPAC with a target.

~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~

Cheap Stocks

Target companies may have issued stocks, or granted stock options or warrants with exercise prices at a price significantly below the public offering price (commonly referred to as cheap stocks). These companies must ensure that they have a sufficient basis to support the valuation of the underlying stock since the Securities and Exchange Commission (SEC) often focuses on cheap stock issues in public offerings.

The target companies should provide an analysis of their cheap stocks based on the AICPA Practice Aid, Valuation of Privately Held-Company Equity Securities Issued as Compensation and other relevant accounting literature. This analysis should specify the reasons for the difference between the estimated IPO price range and the fair value of the awards.

There may be acceptable differences between the price of stocks before or after public offerings. For example, the AICPA Valuation Guide highlights that the valuation of nonpublic entity securities often include a discount for their lack of marketability. There may be other significant, but justifiable differences; for example, the target company might have experienced a discrete event that has caused an increase in the fair value of the underlying stock subsequent to its grant – for example, a biotechnology company might have received the FDA approval of its new experimental drug prior to going public.

There are reasons that target companies might be inclined to issue cheap stocks – e.g., lack of market information for pricing or even intentionally offering lower valuation to attract employees. Furthermore, most private companies issue ISOs, which are not deductible for tax purposes, and that gives them less incentive to assign higher values to their stock awards.

Mezzanine Classification

The SEC requires that registrants classify their equity instruments, which have the following characteristics, as “temporary equity” in the mezzanine section of the balance sheet (between equity and liability) (ASC 718-10-S99-1):

- Equity instruments that are redeemable at a fixed or determinable price on a fixed or determinable date,

- Are redeemable at the option of the equity holder,

- Are redeemable upon the occurrence of an event that is solely within the control of the issuer.

Furthermore, if there are stock awards that are not redeemable due to contingency, and it’s not probable that they will become redeemable, they should be classified in the mezzanine section of the balance sheet, as well (ASC 480-10-S99-3A). However, if such awards are not vested at the grant date, the intrinsic or fair value should be reclassified to mezzanine section as the awards gradually vest. Once the occurrence of the contingent event becomes probable, companies reclassify their stock awards from the mezzanine to liability or equity.

Liability vs. Equity Classification

Companies remeasure the fair value of their liability classified awards at each reporting date until settlement occurs and they reflect any changes in the fair value of the awards in earnings (ASC 718-10-35-6 and 55-112). The Financial Accounting Standards Board (FASB) substantially aligned, with some differences, the accounting for stock awards granted to employees and nonemployees (including customers) pursuant to ASU 2018-07 and ASU 2019-08.

FASB requires companies to classify their stock compensation awards as liabilities for several reasons:

- ASC 718-10-25-7 requires entities apply classification criteria in ASC 480-10-25-4 for mandatory redeemable financial instruments even though stock compensation awards subject to ASC 718 are not within the scope of ASC 480, Distinguishing Liabilities from Equity.

- ASC 718-10-25-13 requires liability classification of the awards that are indexed to something other than a market, performance or service condition.

- ASC 718-10-25-15 requires liability classification of the awards that employee has the choice of settlement in cash or shares, or the employer can choose the method of settlement, but does have the intent to do so.

This is not a complete list since a comprehensive discussion of liability classification of stock awards is beyond the scope of this article.

Compensation Earnouts

Compensation earnouts are contingent post de-SPAC expenses. A SPAC promises certain compensation in a form of stock awards or cash to certain key employees of the target company to maintain their services for a certain period of time or ensure achievement of certain goals within a period of time subsequent to de-SPAC transaction.

Companies usually condition the earnouts based on service, performance or market conditions (e.g., absolute or relative stock price hurdle). Accounting for stock compensation award arrangements in the form of compensation-earnouts is within the scope of ASC 718, Compensation–Stock Compensation.

Awards Conditioned Upon an IPO

The target company may have granted stock awards to certain employees that their vesting is contingent upon a successful IPO. ASC 718 requires that companies that grant stock awards based on a performance condition, such as a successful IPO, recognize the stock compensation expense when it is probable of being achieved (ASC 718-10-30-28). An IPO is generally not a probable event until it occurs and this would suggest that the target company does not recognize stock awards compensation expenses until an IPO occurs.

The target company may also have a call right to cancel the awards upon termination of employment. If so, the call option may raise an issue that if the employee’s right to receive value from the exercise of awards is, in fact, a contingent performance condition. In this scenario, if the target company believes that the termination of awards is imminent due to probable termination of employee, it should classify the awards as liability, since the employee no longer bears the risks and awards associated with the awards (ASC 718-10-25-6 through ASC 10-25-19A).

On the other hand, if the target company does not intend to exercise the call feature, then the target company can classify the awards as equity and recognize the grant date fair value of the awards upon a successful IPO or de-SPAC transaction, based on ASC 718-10-30-28.

Nevertheless, the target company in the post de-SPAC transaction must be cognizant of the fact that exercise of contingent awards upon going public may have a material impact on its earnings per share (EPS).

Employee Stock Purchase Plans

Employee stock purchase plans (ESPPs) are designed to promote employee stock ownership by providing employees with a convenient means to acquire their employers’ shares. It is a contractual promise that permits acquisition of shares on a future date under the terms and conditions that the contract establishes at the grant date.

The acquisition of shares typically occurs through payroll deduction whereby employees set aside a certain percentage of their compensation (usually over one year or less) to purchase their employer’s stock. The employer then uses the amount withheld to acquire the company’s stock from the market at a discounted price at the end of the period and transfer the shares to the employee.

There is a safe harbor level of 5% for the discount that an employer could offer an employee without the ESPP being considered compensatory. If considered compensatory, the fair value of the entire award related to the plan may be included in the calculation of share-based payment compensation cost (ASC 718-50-25-1(a)(2)). The discount typically applies to the lesser of the beginning or ending of the offering period stock price.

After its successful de-SPAC transaction, an acquirer may establish an ESPP and allow employees to enroll in the plan after completion of its public offering. (Privately held companies usually do not have an ESPP plan due to the lack of availability of market price and the marketability of the shares.)

Warrants

The SPAC or target company may have issued warrants that remain outstanding after the de-SPAC transaction. The post de-SPAC transaction company may classify such warrants as equity shares (in the equity or mezzanine sections of balance sheet) or as liabilities. Generally, financial instruments, such as warrants, options or forwards, that involve the issuance of mandatory redeemable instruments are classified as liabilities (ASC 480-10-25-8).

Many companies have typically treated these warrants as equity instruments, but the SEC has started to look closely at the accounting practices connected with these transactions and has noted potentially problematic patterns. The SEC staff has recently stated that such warrants, depending on their terms, should not be treated as equity, but it is rather more appropriate to receive liabilities treatment.

If these warrants are indeed liabilities, companies may need to update the valuation of such awards for each reporting period and reflect the changes of their fair values in their earnings. Therefore, companies that have reclassified their equity awards as liability may need to restate their financial statements for the prior periods.

The SEC has the following two conditions for companies to classify their warrants as liability:

- The warrant settlement varies depending upon the characteristics of the holder of the warrant. (GAAP requires liability classification since the holder is not an input into the pricing of a fixed-to-fixed option on equity shares).

- In the event of a tender or exchange offer made to, and accepted by, holders of more than 50% of the outstanding shares of a single class of common stock, all holders of the warrants are entitled to receive cash for their warrants. (GAAP requires liability classification for such warrants since its settlement is within the company’s control.)

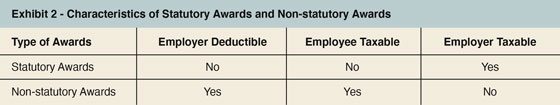

There are two types of stock awards from a tax perspective: statutory awards and non-statutory awards. Exhibit 2 summarizes the characteristics of these two types of stock awards.

Statutory Awards. A privately held company (the target company) usually grants incentive stock options (ISOs) to its employees. There are several reasons for it: for example, the target company may not be profitable and may not benefit from the tax advantages of non-statutory awards or may want to provide an incentive for employees to join the company. Employees prefer ISOs for their tax treatment since the awards are generally not subject to tax until they sell the underlying stock and they can further benefit from the capital gain treatment at a lower rate if their ISOs meet certain statutory requirements.

Non-Statutory Awards. Post IPO companies tend to grant non-qualified stock options (NQSOs) to their employees and non-employees. NQSOs are generally taxable to employees after exercise of options and tax deductible for employers under IRS Section 162. Thus, post IPO companies tend to benefit more from the tax treatment of NQSOs, as they are often more established and profitable.

As companies mature and the growth of stock prices flatten, they tend to grant restricted stock units (RSUs) to their employees and non-employees. RSUs are taxable upon vesting, unlike the NQSOs that are taxable upon exercise. Therefore, a PBE may have ISOs, as well as NQSOs and RSUs in their books.

Earnings Per Share

EPS is one of the most complicated and important measures that PBEs present in their quarterly and annual reports. ASC Topic 260, Earnings Per Share, provides guidance for the calculation and reporting of EPS:

- Basic EPS is calculated by dividing income available to common shareholders by the weighted-average number of common shares outstanding.

- Diluted EPS adjusts basic EPS for the hypothetical issuance of all potentially dilutive securities. The dilutive effects of call options, warrants and stock compensation awards are calculated using the treasury stock method.

The treasury stock method is a method of recognizing the use of proceeds that could be obtained upon the hypothetical exercise of dilutive securities in computing diluted EPS. It assumes that proceeds would be used to repurchase common stock at the average market price during the period.

The hypothetical shares repurchased under the treasury stock method reduce the number of shares outstanding in the denominator of diluted EPS; companies usually take into account the stock compensation awards that are considered dilutive.

Antidilutive shares are excluded from the number of shares outstanding in calculations of dilutive EPS.

The assumed proceeds for the hypothetical repurchase of shares consist of the following (ASC 260-10-45-29):

- The total amount, if any, employees must pay upon the exercise of stock awards. (This provision is applicable to stock options, but not to restricted stock units.)

- The average amount of stock compensation attributed to future services and not yet recognized (average unrecognized stock compensation).

- The amount of excess tax benefits or deficiencies reflected in additional paid-in capital, if any.

The stock compensation awards impact both the numerator and the denominator of EPS:

- Stock options, if dilutive, impact the denominator of dilutive EPS before exercise and the denominator of basic EPS after that.

- ESPPs impact the denominator of dilutive EPS before purchase and transfer of shares to employees and the denominator of basic EPS after that.

- RSUs impact the denominator of dilutive EPS before vesting and the denominator of basic EPS after that.

- Stock compensation expense and its tax effect impact the numerator of EPS.

Dividend-Protected Stock Awards

The recipients of stock awards may be entitled to the dividends that companies pay on their underlying equity shares, while the stock awards are still outstanding but not vested (ASC 718-10-55-45).

FASB considers these divided-protected stock awards as participating securities under certain conditions. Share-based payments that include dividend-protection features, such as dividend payments or adjustments to the exercise price for dividends declared, have certain accounting implications for both expense recognition and EPS calculations.

Dividend-protected stock awards have gained popularity recently due to the emergence of SPACs. These companies often use contingency shareholders or compensation earnout provisions as part of the de-SPAC transaction due to uncertainty in the value of the target companies. In some instances, such equity earnout provisions entitle the holder to nonforfeitable dividends during the vesting or contingency period.

The dividend-protected features of awards impact their fair values and most likely determine their status as participating securities. Participating securities have certain accounting and tax implications; they may require that companies calculate their EPS pursuant to the two-class method.

Financial Planning and Analysis Needed

Stock awards that companies grant to common law employees, independent directors, customers and third-party consultants are subject to provisions of ASC 718. Despite the notable affinity between PBEs and private companies in application of ASC 718 for stock awards, there are nuances that post de-SPAC companies should consider to avoid earnings surprises.

Stock awards conditioned based on IPO and some earn-out arrangements may impact the numerator of EPS significantly. Different stock awards (ISOs, NQSOs and RSUs) impact the denominator of EPS incongruously. Dividend-protected stock awards require companies to calculate their EPS pursuant to two-class method.

All these issues entail that post de-SPAC companies engage in financial planning and analysis prior to drafting their stock awards plans and granting any stock awards.

About the Author:

Josef Rashty, CPA, Ph.D. (Candidate) is a member of the Texas Society of CPAs and provides consulting services in Silicon Valley, California. He can be reached at jrashty@josefrashty.com.