A Chance to Make a Difference

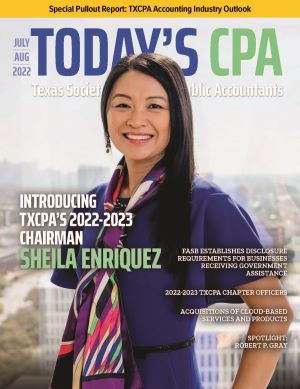

In June, Sheila Enriquez, JD, CPA-Houston, CFF, CVA, began her term as the 2022-2023 chairman of the Texas Society of CPAs (TXCPA). Sheila is the Texas Market Leader and office managing partner at Crowe in Houston. She is also a partner in their advisory group.

As a first-generation immigrant, Sheila understands the power of education and hard work. She strives to cultivate the growth of others and continue to pay it forward. As she began her new role at TXCPA, she sat down with TXCPA President and CEO Jodi Ann Ray, CAE, to talk about her personal and professional journeys, the issues facing the accounting profession, and the opportunity for all Texas CPAs to make a positive difference.

Q. You have more than 26 years of experience in external and internal audit services, forensic accounting, and valuation and litigation support. When did you know you wanted to be a CPA?

I actually did not plan on becoming a CPA. My original plan was to go to medical school. I graduated as valedictorian of my high school class in Baguio City, my hometown in the Philippines, and had a full scholarship to attend the medical school at the University of the Philippines.

Just a few months before graduating from high school in 1990, I also applied for and was one of 10 students selected by a Japanese philanthropist to receive a full scholarship to attend a two-year Associates in Business program with SUNY/Sullivan County Community College (SUNY/SCCC) in its campuses in Toyama, Japan and Loch Sheldrake, New York. It was an opportunity of a lifetime to travel and live in Japan and the U.S. with all expenses covered, while receiving a degree from a U.S. college institution, which would be a major advantage in the Philippines.

After receiving my associates degree from SUNY/SCCC, I was fortunate to receive another scholarship to pursue my bachelor’s degree in business from Mercy College in Dobbs Ferry, New York.

My journey to becoming a CPA was due to a serendipitous event and advice that I received from someone who would turn out to be my greatest mentor. As I approached my last semester pursuing a business degree with a major in management in December 1993, I met with the Dean of the MBA program at LIU-Westchester, which was affiliated with Mercy College in Dobbs Ferry, New York, to ask his permission to take a graduate level class for my remaining three-credit elective. Dean Wayne Cioffari, after noticing that I had a 4.0 GPA, offered me a graduate assistantship to work for him for 20 hours a week in exchange for a free tuition to attend the MBA program at LIU.

During that meeting, he also asked me if I knew anything about the CPA profession and counseled me to pursue my CPA license because as a woman and a minority, it would open doors for me. I found out later that he started a 4+1 MBA/CPA Program for LIU in partnership with Mercy College, whereby I could get an MBA and qualify to sit for the CPA Exam at the same time.

Wayne was way ahead of the times, as this was back in 1993. Although he was not a CPA himself – he was a marketing professor – he was just so focused on helping students rise. Instead of hiring a full-time secretary, he offered high-achieving students the position in exchange for free tuition. It’s amazing what one individual can do to change a person’s life! Through Wayne’s offer, I was able to continue my studies and stay in the U.S., which set me up nicely for future success.

Long story short, I took accounting classes while pursuing my MBA at the same time and graduated with my BS in Public Accounting degree in May 1996 and my MBA degree in September 1996. I sat for the CPA Exam in November 1996 and found out in February 1997 that I passed all four parts!

As an international student, I had limited employer prospects and Wayne once again opened a door for me by recommending me to the managing partner of a financial and management consulting firm, Brenner, McDonagh & Tortolani (BMT). The firm hired me and sponsored me for my H-1B working visa. The process related to international students is challenging for students and companies that choose to sponsor them, but BMT took a chance on me. I started at the New York office and moved to Rhode Island after a partner retired there.

I then moved to a local CPA firm in Rhode Island, Sparrow, Johnson & Ursillo, to get the required audit hours to finally get licensed. I discovered that public accounting was the right place for me and throughout my eight-year tenure at the firm, I was able to get exposure to audit, tax and consulting work.

Taking a leap of faith, my husband and I decided to move with our then three-year old son, Anthony, to Houston in 2006 for personal reasons and was fortunate to have found Briggs & Veselka, where I started as a manager in 2007 and took over as CEO/managing partner in 2018. I have been blessed with great employers and Briggs & Veselka, in particular, was the right fit for me.

I thrived and developed quickly within Briggs & Veselka, under the guidance and tutelage of the partners, especially John Flatowicz, who recognized my potential before I even did. Briggs & Veselka also lived up to its promise to give me the flexibility to raise a family, attend law school in the evenings from 2007-2008, and provide growth and development opportunities throughout my tenure. With its inclusive culture, I was able to bring my whole self to work.

We recently joined Crowe and I am optimistic that we have joined the right firm, as we share the same purpose and values that put our people first.

Q. As you have progressed in your career, what aspects have been the most rewarding and most challenging?

The most challenging aspects have also been the most rewarding. Throughout my career journey, I’ve had leaders who saw my potential and encouraged me to stretch and challenge myself by taking on new engagements and roles.

There were numerous times when I was offered roles that I did not know I was ready for, but through the support of my mentors, I challenged myself to step up and learn and thrive. These experiences and roles have given me the opportunity to make a difference, work with amazing people, and develop, inspire and be an example to others. The profession has been so good to me and I am so grateful! I am, therefore, committed to mentoring and helping others achieve their potential, as well.

Q. What person or people have been the biggest influence(s) or role model(s) for you and why?

They would have to be my parents. Growing up, I saw them live their values of faith, love and charity. I was one of six kids, and we were raised to believe there are no limits, but we should always look for ways to help others.

My father passed away last year and in his 85 years of life, he was so generous to everyone and never turned away anyone in need. He treated each person equally with respect and care. In his job as a teaching professional golfer, he mingled with presidents and very influential people, but he always treated his caddies and the serving staff the same way.

My mom is a serial entrepreneur and is a great example of a woman who defies limits. She is very enterprising and a problem solver. I learned resilience from her.

Q. In our current environment, what issues do you see facing TXCPA and the accounting profession in the next several years?

No question, the most important and challenging issue we face is our pipeline. We must change our image and how the public perceives us. We have an amazing profession – one that is purpose-driven and helps businesses/organizations thrive, fulfill their mission and help the economy.

We need to do a better job of sharing that purpose by telling our own personal stories so that young kids and their parents see that becoming a CPA and being part of this profession are at the level of being a doctor, lawyer or public servant. I am a lawyer myself, but I consider myself a CPA first.

Other issues are remaining relevant and being nimble and agile to meet the changing demands of our various constituencies.

I believe we have to build an ecosystem that requires us to partner with organizations and other professionals that share our mission. Our profession will continue to be a CPA-led profession if we remain proactive and nimble, even as we welcome non-CPAs in our ranks, but we must be able to articulate the value of our profession in a clear, concise way that resonates with our audience.

Q. You have been involved with TXCPA and TXCPA Houston as a volunteer leader. Why is volunteering so important to you?

I am paying it forward because I truly believe in this profession and I want others to know just how amazing this profession is. I am a great example of someone who enjoys a fulfilling career without giving up my personal life in the process because of my CPA designation.

Q. What other types of activities are you involved in as a professional?

In addition to my active involvement in the CPA profession (at the state, local Houston Chapter and national level as a member of the AICPA Governing Council), I am on the board of University of St. Thomas, the only Catholic college in Houston.

My faith and family come first, but in addition to the profession, I am deeply passionate about education because I believe it to be the great equalizer that lifts up generations of people. My involvement with UST enables me to cultivate my faith while being involved in an institution that is changing lives as we speak. As the beneficiary of a scholarship myself, which allowed me to attend college, be the first in my family to graduate from college and reach the success that I enjoy today, I am committed to paying things forward.

I am also a member of the State Bar of Texas and the American Cancer Society’s CEOs Against Cancer Houston Chapter.

Q. Tell us about your family. What do you enjoy doing when you’re not working?

I have an amazing husband, Jose, who is the wind beneath my wings. We met 32 years ago when we were both scholars studying at SUNY/SCCC in its campuses in Toyama, Japan and Loch Sheldrake, New York.

We just celebrated our 22nd wedding anniversary in May and we have been blessed with two boys, Anthony and Jacob.

Anthony is 19 and just completed his freshman year at The University of Texas at Austin’s McCombs School of Business. I’m thrilled that he has recently decided to pursue accounting as his major and will minor in MIS! Jacob is 12 and finishing up 7th grade. We also have a new addition to our family, Doc, an Australian labradoodle we adopted in May. He has already stolen our hearts!

We love to travel and see the world! Traveling has helped me broaden my perspective and I have come to recognize that no matter what country we live in, we are more alike than different.

During my spare time, I also love to play golf and tennis. Golf is near and dear to me as my father taught golf for a living for 50 years and instilled the love of the game to all his children and grandchildren.

Interesting Facts About Sheila Enriquez, JD, CPA-Houston, CFF, CVA

TXCPA’s 2022-2023 Chairman Sheila Enriquez:

- Was born and raised in the Philippines

- Received a full scholarship in 1990 and completed her A.S. in Business with High Honors at SUNY/SCCC’s Toyama, Japan and Loch Sheldrake, New York campuses

- Attended Mercy College on a merit scholarship and graduated summa cum laude with a B.S. Degree in Public Accounting

- Received her MBA with Distinction from Long Island University and her JD from the University of Houston Law Center

- Enjoys golf, tennis, and traveling in the U.S. and abroad

She has actively served in the following organizations:

- TXCPA – Chairman, Board Member, Executive Board Member, TXCPA Houston Past President

- American Institute of CPAs – Governing Council

- National Association of Certified Valuators and Analysts – Member

- The State Bar of Texas – Member

- University of St. Thomas – Executive Board Member

- American Cancer Society CEOs Against Cancer Gulf Coast – Chapter Member