TXCPA Accounting Industry Outlook

The adoption of technologies, the pace of change, the response to the pandemic, and finding and retaining talent are all key issues impacting the accounting profession in Texas.

The research finds organizations that are likely to have the highest projected business increase are moving toward more advisory services in the business mix, more hiring of all types of employees, including part-time workers, and have the least amount of tax work in the business mix.

By DeLynn Deakins

Today’s CPA Managing Editor

Over the last several years, the accounting profession has seen a rapid acceleration in the pace of change. The response to the pandemic resulted in a sudden shift to working remotely, which has helped drive the adoption of technologies that enable employees to work from anywhere in the world.

Finding and retaining talent is critical, and businesses and accounting firms that don’t embrace a flexible or hybrid working environment with a robust benefits package as part of their culture risk losing or attracting their best employees. The current environment is filled with both challenges and opportunities.

These are some of the issues impacting the accounting profession landscape in Texas that TXCPA identified in the all-new Accounting Industry Outlook Report.

In May, TXCPA surveyed members and non-members for the first of two outlook reports scheduled for 2022. TXCPA is working with a third-party professional research firm to conduct these studies. This initial survey and resulting report focused on benchmarking and creating a baseline report of issues facing the profession, businesses and accounting organizations.

Of those who responded to our initial survey, 43.6% identified as working in the area of business and industry, 35.5% in public practice, 5.6% in government, 4.9% in education, and 10.3% considered themselves as working in other areas. Read on for a summary of their responses.

Top Issues Facing the Accounting Profession

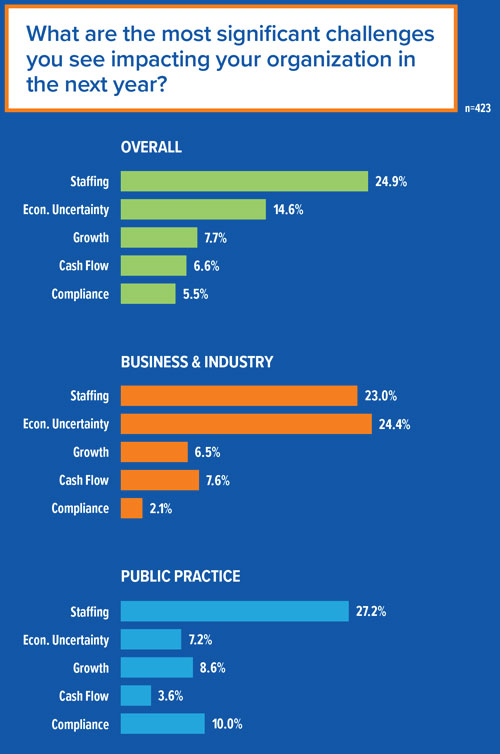

It should be no surprise that the top issue impacting public accounting firms is staffing. Other top issues identified by public accounting respondents were compliance issues, growth issues and economic uncertainty. For business and industry, economic uncertainty was identified as the top issue, followed closely by staffing. Cash flow and growth were also cited.

For both public practice and business and industry organizations, it remains a challenge to hire adequate staff. Taking a closer look at the staffing challenges, what are some of the contributing factors? As with other businesses, the “Great Resignation” is having a major impact on the accounting profession. Baby boomers, who make up a significant portion of the profession, are retiring at a rapid pace. New professionals are joining the ranks, but there is an ongoing difficulty recruiting diverse candidates to the profession.

The profession has also been struggling with a value proposition as students weigh the demands of a career in accounting with salary and benefits not fairly compensating for these demands. Work/life balance is a top priority for young professionals.

In addition, there has been a lower number of CPA Exam candidates nationally. The result is a shortage of qualified staff and intense competition for talent.1

When asked what they are doing to attract talent or be an employer of choice, respondents in public practice firms most frequently cited:

- Emphasizing an employee-focused culture (15.6%)

- Improved benefits (15.1%),

- Flexible scheduling (15.1%); and

- Competitive pay scale (11.7%).

Respondents in business and industry most frequently cited:

- Improved benefits (20.3%);

- Competitive pay scale (20.3%);

- Emphasizing an employee-focused culture (15.9%); and

- Flexible scheduling (7.8%).

Diversity, Equity and Inclusion Initiatives

Incorporating diversity, equity and inclusion (DEI) in business plans and within goals is important for businesses in today’s competitive environment. Workplace belonging and “meeting employees where they are” can lead to increased job performance and a reduction in turnover risk. Businesses can’t afford to miss out on the positive impact on recruitment and retention that comes when they prioritize DEI initiatives.

This is an area of opportunity for the accounting profession in Texas. Strikingly, nearly 80% of respondents in public practice and a little more than half of respondents in business and industry (52.7%) reported having no DEI initiatives.

Of the survey respondents in public practice firms:

- 11.5% said they had DEI initiatives that were effective;

- 5.7% said they had DEI initiatives, but they were not as effective as they could be;

- 2.9% said they had DEI initiatives, but they were mostly ineffective.

Of the survey respondents in business and industry:

- 24.9% said they had DEI initiatives that were effective;

- 16.8% said they had DEI initiatives, but they were not as effective as they could be;

- 5.5% said they had DEI initiatives, but they were mostly ineffective.

A Changing Business Mix

Over the next year, public practice firms appear to be poised to move slowly away from traditional tax preparation services to offer more advisory services. Looking ahead to the mix of business anticipated in mid-2023 compared to mid-2022, there was a statistically significant drop in the amount of tax work public practitioners anticipate completing for clients, going from 59.1% in 2022 down to 56.5% in 2023.

Advisory services were expected to rise from 6.9% to 8.0%, while audit work, client accounting services and the “other” category remained approximately the same.

The prospects for business growth were mostly positive for both public practice and business and industry respondents. In this area, 43.9% of business and industry respondents and 47.2% of public practice respondents said they expect business to be up by as much as 10%. Another 14.9% of business and industry respondents and 14.0% of public practice respondents said they expect business to be up by more than 10%.

ESG Initiatives

Environmental, social and governance (ESG) issues are becoming increasingly important. Consumer demand and government-mandated action for environmental sustainability are likely to drive business adoption of sustainable practices. Businesses will be required to measure and reduce their greenhouse gas emissions. ESG issues are also becoming key considerations and a major attraction for global investors who are concerned about issues related to sustainability and climate change.

This offers the accounting profession a significant opportunity, as managing sustainability requires risk assessment and reporting skills.

As efforts in this area evolve, accounting professionals are in an ideal position to innovate by offering services to help their clients and employers measure the degree to which they are operating sustainably.2

Many public practice firms in Texas are not currently providing support for ESG reporting. In fact, 82.5% of public practice respondents in our survey said they were not providing these services. Of the business and industry respondents, a little more than half (53.1%) said their organizations were providing these services.

Are more companies moving to additional ESG reporting? For business and industry, respondents said:

- Yes, somewhat (46.7%)

- No, not at all (22.5%)

- Yes, notably (21.9%)

- Yes, a great deal (8.9%)

Respondents in public practice said:

- No, not at all (55.6%)

- Yes, somewhat (34.3%)

- Yes, notably (9.1%)

- Yes, a great deal (1.0%)

Technology Investment

Companies and accounting firms are continuing to adopt advanced technologies and systems that help them remain competitive and retain sustainable growth.

The shift to digital transformation has been accelerated by the pandemic, with changes to remote working practices that have necessitated investment in cloud computing and cybersecurity technologies. In addition, the accounting software market has continued to grow.

To help support or manage their business, survey respondents in public practice cited most often that they are investing in hardware, cloud computing, accounting software, tax software, the category of artificial intelligence, technology and cybersecurity, and “other” technologies.

Respondents in business and industry cited most often that they are investing in enterprise resource planning (ERP), cloud computing, the category of artificial intelligence, technology and cybersecurity, hardware, accounting software, and “other” technologies.

Summary of the Data

The survey data identified attributes of organizations that are likely to have the highest projected business increase. In these organizations, there is a move toward more advisory services in the business mix, more hiring of all types of employees, including part-time workers, and they have the least amount of tax work in the business mix.

Attributes associated with the least amount of projected business increase include having mostly tax work in the business mix and the least amount of new employee hiring. They are also least likely to have an in-house DEI program or to be engaged with ESG.

This initial survey of the accounting profession landscape in Texas provided important baselines and benchmarks for future surveys. TXCPA thanks those who participated in this research and we look forward to future reports where we will continue to identify trends that will impact businesses and accounting organizations in the years to come.

You Can Sponsor TXCPA’s Accounting Industry Outlook

Twice each year, TXCPA will survey accounting and finance professionals and ask them to help us look out over the horizon for issues they see that will be important to their business and profession.

If you would like to sponsor the TXCPA Accounting Industry Outlook, please contact our Media Representative Lisa Turner at lisaturner@lmtmedia.com or 941-400-7419.

Footnotes

1“State of the Accounting Profession 2022 Via the AICPA Trends Report.” Goingconcern. April 20, 2022. www.

goingconcern.com/details-on-new-hires-most-in-demand-service-lines-cpa-exam-numbers-and-more-from-the-latest-aicpa-trends-report/

2 “What are the key accounting industry trends to watch in 2022?” AccountancyAge. Jan 26, 2022. www.accountancyage.com/2022/01/26/what-are-the-key-accounting- industry-trends-to-watch-in-2022/