Private Company Accounting Alternatives and Practical Expedients

By Steve Grice, Ph.D., CPA, and Josh McGowan, DBA, CPA

Over a decade ago, the Financial Accounting Standards Board (FASB) established the Private Company Council (PCC) to address accounting concerns associated with private companies. The PCC proposes either an accounting alternative or a practical expedient when it is deemed that recognition and measurement differences between public and private companies are warranted. An accounting alternative is a different accounting method for recognizing or measuring a specific transaction or event. A practical expedient is not a different accounting method, but rather, it is a less costly and less complex way to apply the certain accounting guidance.

FASB has issued several Accounting Standards Updates (ASU) in response to recommendations of the PCC. This guidance is based on the Private Company Decision-Making Framework: A Guide to Evaluating Financial Accounting and Reporting for Private Companies that focuses on user-relevance and cost-benefit considerations associated with private company accounting guidance. The purpose of this article is to provide an understanding of the accounting alternatives and practical expedients that have been issued as a result of the joint effort between FASB and the PCC.

Accounting Alternative for Goodwill

FASB issued ASU 2014-02, entitled Accounting for Goodwill, to provide private entities with an accounting alternative related to goodwill accounting. Initially, this accounting alternative was available to all entities except public entities, not-for-profit entities and employee benefit plans. Subsequently, FASB issued ASU 2019-06, entitled Extending the Private Company Accounting Alternatives on Goodwill and Certain Identifiable Intangible Assets to Not-for-Profit Entities, to extend the accounting alternative to not-for-profit entities (NFP).

Prior to ASU 2014-02, all entities were required to annually evaluate goodwill for impairment using a qualitative or quantitative approach. The provisions of ASU 2014-02 allow private entities to elect an accounting alternative related to the subsequent accounting for goodwill. Pursuant to the accounting alternative, entities may elect to amortize goodwill over a 10-year period or less, if a shorter period is deemed more appropriate. This accounting alternative may be elected for the goodwill that exists at the beginning of the annual period in which the accounting alternative is elected, as well as for the goodwill that arises subsequent to the election.

The goodwill accounting alternative also includes a simplified impairment test for goodwill. Though entities now have the option to amortize goodwill, all entities that elect this accounting alternative must also establish an accounting policy to test goodwill for impairment when a triggering event indicates that the carrying value of the reporting unit may be below its fair value.

When a triggering event occurs, entities must assess whether it is more-likely-than-not (MLTN) that the fair value of the reporting unit is less than its carrying amount, including goodwill. For years, reporting entities have used the two-step impairment test discussed in ASC 350, entitled Intangibles-Goodwill and Other, to determine the amount of impaired goodwill.

Step one of the two-step impairment test requires the reporting entity to compare the fair value of the reporting unit with its carrying amount, including goodwill. Step two requires the reporting entity to compare the implied fair value of the reporting unit’s goodwill with the carrying amount of that goodwill. The simplified impairment test in the accounting alternative eliminates step two of the impairment test model.1 By eliminating step two, entities that elect the goodwill accounting alternative are no longer required to perform the hypothetical application of the acquisition method to calculate the impairment loss. That is, the impairment loss is the amount in which the carrying amount of the reporting unit exceeds its fair value including goodwill. The amount of the goodwill impairment loss cannot exceed the carrying amount of goodwill.

Private entities that elect the goodwill accounting alternative presented in ASU 2014-02 are generally required to provide the same disclosures as before (see disclosures in ASC 350-20-50). One exception is that entities are no longer required to provide a reconciliation of changes in goodwill in a tabular format when this accounting alternative is elected.

Practical Expedient for Hedge Accounting

FASB issued ASU 2014-03, entitled Accounting for Certain Receive-Variable, Pay-fixed Interest Rate Swaps-Simplified Hedge Accounting Approach, to provide a practical expedient for private companies referred to as the simplified hedge accounting approach. Pursuant to the provisions of ASU 2014-03, private entities may elect to apply a simplified hedge accounting approach when they enter into a receive-variable, pay-fixed interest rate swap to economically convert a variable-rate borrowing to a fixed-rate borrowing. Prior to this ASU, all private entities were required to comply with the complex, and often cumbersome, provisions of Topic 815, entitled Derivatives and Hedging, with limited resources which made compliance difficult.

This practical expedient is available to all entities except public entities, not-for-profit entities, employee benefit plans, and financial institutions (which includes banks, savings and loans, savings banks, insurance entities, credit unions, and finance companies).

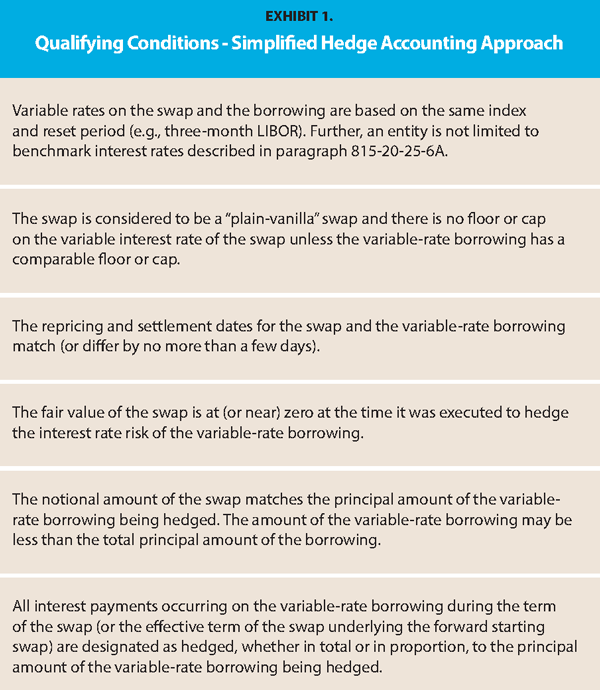

The simplified hedge accounting approach serves as a practical expedient to qualify for cash flow hedge accounting. The practical expedient allows entities to assume no ineffectiveness for qualifying interest rate swaps that are designated in a hedging relationship with a variable-rate borrowing. Paragraph 815-20-25-131D has the conditions that must be met in order to apply the simplified hedge accounting approach to a cash flow hedge involving a receive-variable, pay-fixed interest rate swap, and a variable-rate borrowing. Those conditions are shown in Exhibit 1.

The simplified hedge accounting approach allows private entities to measure the interest rate swap at the settlement value as opposed to the fair value, which requires consideration of nonperformance risk. According to ASU 2014-03, one approach to determining the settlement value of a receive-variable, pay-fixed interest rate swap is to calculate the present value of the remaining cash flows using a valuation technique not adjusted for nonperformance risk.

The fair value measurement disclosures continue to apply to interest-rate swaps under the simplified hedging accounting approach. ASU 2014-03 says that the disclosures for amounts shown at settlement value are the same as those required for amounts shown at fair value.

A significant difference in the documentation requirements relates to the timing of the documentation. Prior to ASU 2014-03, the formal documentation required by Topic 815 relating to the hedging relationship, the entity’s risk management objective and strategy for undertaking the hedge and other items specific to cash flow hedges were required to be in place at the inception of the hedge (see ASC 815-20-25-3) in order to qualify for hedge accounting.

According to ASU 2014-03, the formal documentation must be completed by the date on which the first annual financial statements are available to be issued following the hedge inception. This amendment to the documentation requirement will allow private entities more time to prepare the required documentation for new hedging relationships entered during an accounting period.

It should be noted that ASU 2014-03 specifically states that an interest rate swap subject to a simplified hedge accounting approach is not considered a derivative instrument for purposes of determining whether the fair value disclosures required by Topic 825, entitled Financial Instruments, are required.

Accounting Alternative for Identifiable Intangible Assets

FASB issued ASU 2014-18, entitled Accounting for Identifiable Intangible Assets in a Business Combination, to provide an accounting alternative for private entities when accounting for identifiable intangible assets in a business combination. Initially, this accounting alternative was available to all entities except public entities and NFP entities. Subsequently, ASU 2019-06 extended this accounting alternative to NFP entities.

Prior to ASU 2014-18, reporting entities were required to recognize certain identifiable intangible assets separately from goodwill. Before the intangible asset accounting alternative was issued by FASB, ASC 805-20-25-10 required reporting entities to recognize certain identifiable assets acquired in a business combination separately from goodwill. The intangible assets are deemed to be identifiable when those assets meet either the separability criterion or the contractual-legal criterion described in the definition of identifiable.

Essentially, an asset meets the separability criterion when it is capable of being sold, transferred, licensed, rented, or exchanged and the contractual legal criterion when it arises from contractual or other legal rights.

The intangible asset accounting alternative is applicable when an entity within the scope of the guidance is required to recognize (or consider the fair value of) intangible assets as a result of the:

- Application of acquisition method pursuant to ASC Topic 805, entitled Business Combinations;

- Assessment of the nature of the difference between the carrying amount and the underlying equity in net assets related to an equity method investment pursuant to ASC Topic 323, entitled Investments-Equity Method and Joint Ventures;

- Adoption of fresh-start accounting pursuant to ASC Topic 852, entitled Reorganizations.

ASC 805-20-55-13 uses the following categories to describe the types of intangibles that must be evaluated for separate recognition apart from goodwill:

- Marketing-related intangible assets (which include non-competition agreements);

- Customer-related intangible assets;

- Artistic-related intangible assets;

- Contract-based intangible assets;

- Technology-based intangible assets.

The intangible asset accounting alternative allows entities to no longer recognize certain intangible assets separately from goodwill. Specifically, the guidance indicates that intangible assets related to (1) customer-related intangible assets that are not capable of being sold or independently licensed and (2) non-compete agreements should not be recognized separately from goodwill when an NFP entity elects the intangible asset accounting alternative.

Examples of customer-related intangible assets shown in ASC 805-20-55-20 include customer lists, order backlogs, customer contracts and noncontractual customer relationships. According to ASU 2014-18, when an entity elects the intangible asset accounting alternative, it must also apply the goodwill accounting alternative to amortize goodwill. However, an entity may elect the goodwill accounting alternative without electing to apply the intangible asset accounting alternative.

ASU 2014-18 stipulates that when an entity elects the intangible asset accounting alternative, it must apply the accounting alternative to all subsequent transactions that are within the scope of ASU 2014-18.

Accounting Alternative for Variable Interest Entities

FASB issued ASU 2014-07, entitled Applying Variable Interest Entities Guidance to Common Control Leasing Arrangements, to provide an accounting alternative for private companies related to accounting for variable interest entities (VIE). Subsequently, ASU 2018-17, entitled Targeted Improvements to Related Party Guidance for Variable Interest Entities, superseded the guidance in ASU 2014-07 and expanded the accounting alternative related to the application of the VIE consolidation model.2 The common scenario for private entities that triggers the issues associated with VIE accounting is one where a common owner establishes a lessor entity separate from the private entity.

For example, assume that the owner of Sigma Co. forms Gamma LLC to hold the operating real estate and that Sigma Co. enters into a lease with Gamma LLC. In this situation, Sigma Co. must determine (1) whether it holds a variable interest in Gamma LLC, (2) whether Gamma LLC is a VIE, and (3) whether it is the primary beneficiary of Gamma LLC. The VIE model requires consolidation if Sigma Co. holds a variable interest in Gamma Co., Gamma Co. qualifies as a VIE, and Sigma Co. is the primary beneficiary of Gamma Co.

The initial VIE accounting alternative in ASU 2014-07 allowed private entities an election to not apply the VIE model to commonly owned lessor and lessee entities such as Sigma Co. and Gamma Co. in the example above. ASU

2018-17 expanded the alternative to all legal entities under common control, not just common controlled leasing arrangements. ASU 2018-17 establishes criteria that, if met, would allow a private company to elect the accounting alternative to not apply

the VIE consolidation guidance. The criteria for the election of the accounting alternative to the VIE guidance is shown in Exhibit 2 (all four criteria must be met).

The initial VIE accounting alternative in ASU 2014-07 allowed private entities an election to not apply the VIE model to commonly owned lessor and lessee entities such as Sigma Co. and Gamma Co. in the example above. ASU

2018-17 expanded the alternative to all legal entities under common control, not just common controlled leasing arrangements. ASU 2018-17 establishes criteria that, if met, would allow a private company to elect the accounting alternative to not apply

the VIE consolidation guidance. The criteria for the election of the accounting alternative to the VIE guidance is shown in Exhibit 2 (all four criteria must be met).

The accounting alternative in ASU 2018-17 is an accounting policy election and must be applied to all current and future legal entities under common control that meet the criteria. The required disclosures are significantly reduced when a private entity elects the accounting alternative. The required disclosures are shown in ASC 810-10-50-2AG, ASC 810-10-50-2AH, and ASC 810-10-50-2AI. ASU 2018-17 indicates that the reporting entity should consider exposure through implicit guarantees (e.g., the reporting entity has an economic incentive to serve as a guarantor) when preparing the disclosures. Importantly, the disclosures required by other ASC Topics are still applicable. For example, disclosures related to guarantees, leases, related parties, and other relevant disclosures are required.

Accounting Alternative for Triggering Events

FASB issued ASU 2021-03, entitled Accounting Alternative for Evaluating Triggering Events, to address the cost and complexity associated with evaluating triggering events and measuring the impairment of goodwill. Prior to ASU 2021-03, all entities were required to evaluate triggering events during the reporting period. Triggering events include relevant events and circumstances that could indicate that the fair value of the reporting unit is less than its carrying value. ASC 350-20-35-3C provides numerous examples of these events and circumstances (e.g., deterioration in general economic conditions, increased competitive environment, etc.).

ASU 2021-03 provides a triggering event accounting alternative to allow a reporting entity to evaluate the triggering events that could potentially impair goodwill as of the end of the reporting period. Thus, entities that elect this accounting alternative no longer have to monitor goodwill impairment triggering events during the reporting period. Essentially, the triggering event evaluation date and the reporting date are aligned under the ASU 2021-02 accounting alternative.

Valuing Share-Based Awards

FASB issued ASU 2021-07, entitled Determining the Current Price of an Underlying Share for Equity-Classified Share-Based Awards, to provide private entities a practical expedient associated with valuing share-based awards classified as equity. ASC Topic 718, entitled Compensation-Stock Compensation, requires that share-based awards be recognized at the grant date fair value. Paragraph 718-10-30-9 indicates that the fair value of these share-based awards should be estimated using a valuation technique such as an option-pricing model.

For example, the Black-Scholes option-pricing model is specifically identified as a potential valuation technique in the Topic 718 implementation guidance. The inputs required by the Black-Scholes model are shown in Exhibit

3.

For example, the Black-Scholes option-pricing model is specifically identified as a potential valuation technique in the Topic 718 implementation guidance. The inputs required by the Black-Scholes model are shown in Exhibit

3.

The Black-Scholes model, as well as other option-pricing models, requires inputs that may be difficult to identify for private companies. Specifically, the inputs include the current share price of the equity shares underlying the option. The PCC noted that the current share price input is perhaps the most difficult input for private entities to determine because the shares are not actively traded.

The practical expedient in ASU 2021-07 allows private companies to estimate the current share price input using the reasonable application of a reasonable valuation method for share-based awards classified as equity. Importantly, the practical expedient may not be used for share-based awards classified as liabilities. The reasonable application of a reasonable valuation method is the same method that is mentioned in the Internal Revenue Code regulations of the U.S. Treasury Department related to Section 409A (see 26 CFR § 1.409A-1- Definitions and covered plans). ASU 2021-07 indicates that a valuation performed pursuant to U.S. Internal Revenue Code at 26 CFR § 1.409A-1-(b)(5)(iv)(B) is an example of a valuation that is reasonable under the practical expedient.

ASU 2021-07 requires that the facts and circumstances, as of the measurement date, be the bases for determining whether a valuation is reasonable or whether an application of a valuation method is reasonable. ASC 718-10-30-20D provides the following list of factors that should be considered under a reasonable valuation method:

- Value of tangible and intangible assets;

- Present value of anticipated future cash flows;

- Market value of equity interests in similar entities engaged in substantially similar trades or businesses; the value of which can be readily determined through nondiscretionary, objective means (e.g., through trading prices on an established securities market or an amount paid in an arm’s-length private transaction);

- Recent arm’s-length transactions involving the sale or transfer of the private entity’s equity interests;

- Other relevant factors such as control premiums or discounts for lack of marketability and whether the valuation method is used for other purposes that have a material economic effect on the private entity, its stockholders or its creditors;

- The private entity’s consistent use of a valuation method to determine the value of its stock or assets for other purposes, including for purposes unrelated to compensation of service providers.

These factors are similar to those provided in the U.S. Internal Revenue Code at 26 CFR § 1.409A-1-(b)(5)(iv)(B), which provides guidance for determining stock value for income tax purposes when the stock is not readily tradable on an established securities market.

ASU 2021-07 indicates that a valuation method is not reasonable if it does not take into account all available information that is material to the private entity’s value. Also, guidance related to a private entity’s use of previously calculated values is provided in ASC 718-10-30-20F. Specifically, a previously calculated value is no longer reasonable at a later date if either of the following conditions is met:

- The calculation fails to reflect all available information after the date of the original calculation that is material to the private entity’s value (e.g., resolution of material litigation or issuance of a patent);

- The value was calculated more than 12 months earlier than the date for which the valuation is being used.

The guidance indicates that the population of valuations that would be appropriate for the practical expedient (i.e., considered the reasonable application of a reasonable valuation) is not limited to an independent appraisal. For example, internal valuations may exhibit the characteristics of valuations that are appropriate under the practical expedient. However, ASU 2021-07 indicates that it is expected that an independent appraisal will likely be the most common method used when the practical expedient is elected.

Transition Guidance and Effective Dates

FASB issued ASU 2016-03, entitled Effective Date and Transition Guidance, to remove the effective dates and indefinitely extended the transition guidance for ASUs 2014-02, 2014-03, 2014-07 (subsequently superseded by ASU 2018-17), and 2014-18. Essentially, this allows private entities to forgo an initial preferability assessment upon adoption, which was previously required if an entity adopted the guidance after the effective date. Exhibit 4 summarizes the transition provisions for the accounting guidance discussed in this article.

About the Authors: Steve Grice, Ph.D., CPA, is a Scholar-in-Residence at Troy University. Josh McGowan, DBA, CPA, is Assistant Professor Troy University. Contact him at jmcgowan@troy.edu.

1 ASU 2017-04, entitled Simplifying the Test for Goodwill Impairment extended this simplified impairment test to public entities and all other entities that have not elected the private company accounting alternative. ASU 2017-04 is effective for fiscal years beginning after December 15, 2021, for NFP entities that do not elect the goodwill accounting alternative.

2 Interpretation No. 46 entitled, Consolidation of Variable Interest Entities an interpretation of ARB No. 51, and subsequently, Interpretation No. 46(R) entitled, Consolidation of Variable Interest Entities, ushered in the

VIE consolidation model.