July 01, 2024

Corporate Transparency Act: An Update

By Nathan George, CPA, and Ken Horwitz, CPA, JD, LLM

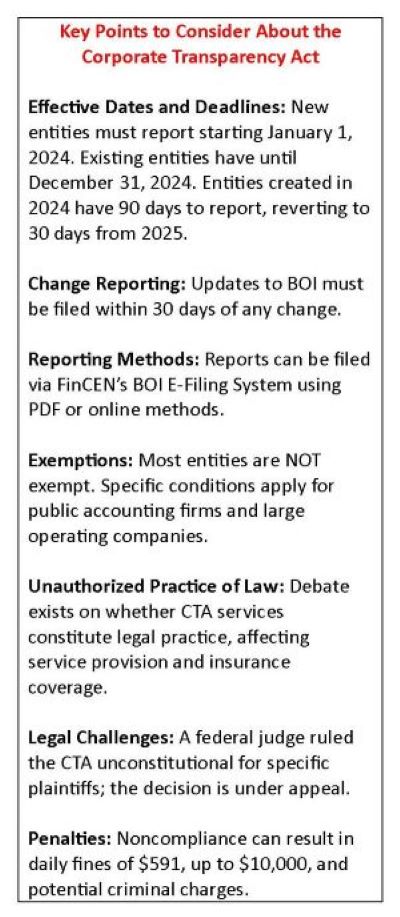

In our previous article (September/October 2023 Today’s CPA), we discussed the details of the Corporate Transparency Act (CTA) and provided a summary of its provisions. Now that we have passed the 60-day mark since its implementation, we would like to provide an update on the latest issues surrounding the program.

January 1, 2024: CTA Goes into Effect

Despite numerous calls for delaying the filing deadline (including comment letters from both AICPA and TXCPA1), Beneficial Ownership Information (BOI) reporting under the CTA went into effect on January 1, 2024, for new entities formed on or after that date. Companies existing prior to January 1, 2024, have until December 31, 2024, to file their initial report.

Despite choosing not to extend the initial effective date, the U.S. Department of the Treasury and Financial Crimes Enforcement Network (FinCEN) did provide reprieve for companies created or registered in 2024, but not thereafter, by allowing 90 calendar days (instead of the initial 30-day period) to file its initial BOI report.

What if reported information changes after the initial filing? Any change to the required information about the company or its beneficial owners requires the filing of an updated report no later than 30 days after the date of the change. It is important that this rule be communicated to persons designated as “Beneficial Owners” together with the types of changes (including personal – not just business information) that trigger the supplemental reporting requirement.

As outlined in the FAQs, the need to update a BOI report may be triggered by changes such as (but not limited to):

- Any change to the information reported for the reporting company, such as registering a new business name;

- A change in beneficial owners or a sale or other transaction that changes who meets the 25% ownership threshold;

- Any changes to a beneficial owner’s name, address or unique identifying number previously provided to FinCEN. If a beneficial owner obtained a new driver’s license or other identifying document that includes a changed name, address or identifying number, an updated report would be required, including an image of the new identifying document.2

A few important observations. First, the deadline for filing the report is based on the date of receiving the actual or public notice that the entity’s creation or registration is effective.3

Second, the 90-day period for initial reporting only applies to entities created in 2024. Based on current guidance, the initial reporting deadline will revert back to the 30-day standard for companies created or registered on January 1, 2025, or after.

Third, as noted, the 30-day period still applies to any changes to the required reporting information.

Fourth, there may be multiple “Beneficial Owners” required to be disclosed for any particular reporting entity; the determination and identification of all may be complex when, for example, the ownership is through tiered entities or there are one or more trusts in the ownership structure. Care needs to be taken and legal counsel may be advisable in such situations.

How to Report

On January 1, 2024, FinCEN opened its BOI E-Filing System4 by which reports can be submitted via two primary methods.

1. File PDF BOIR

- Adobe Reader is required

- Prepare report offline at your own pace, save as you go

- Reuse PDF BOIR when filing updates/corrections

- Download BOIR transcript upon submission

2. File Online BOIR

- Adobe Reader not required

- Prepare online and submit now

- Prepare new online BOIR when filing updates/correction

- Download BOIR transcript upon submission

In addition to these methods, some (tax) providers are offering software by which reports can be transmitted. It seems this may be separate from the typical tax suite and may vary by provider. A sample of the form can be found and questions can also be submitted via FinCEN’s website.5

Unresolved Issues and Navigating the Complexities

Although the guidance may seem straightforward, there are numerous potential pitfalls and areas around which practitioners need to navigate.

No Exemption for You!

While there are many types of exemptions from BOI reporting requirements, it is likely your firm does not meet any of them. Among the 23 specific types of exempted entities is one for “public accounting firms.” To qualify, the entity must be “a public accounting firm registered in accordance with section 102 of the Sarbanes-Oxley Act of 2002.”6

As Friedlich explains, “(t)he Act requires public accounting firms to register with the Public Company Accounting Oversight Board (PCAOB) to prepare or issue an audit report for a U.S. public company or broker-dealer or play a substantial role in those audits … While there are more than 1,605 public accounting firms registered with the PCAOB, many small accounting firms are not among them.”7 Large firms, however, may be able to meet the large operating company if the entity meets the following criteria:

- Employs more than 20 full time employees who are employed in the United States;

- Has an operating presence at a physical office within the United States;

- File a federal income tax or information return in the previous year with more than $5,000,000 in gross receipts or sales. (Note: receipts or sales sourced outside the U.S. are to be excluded in meeting the threshold requirement);

- Reported the greater-than-$5,000,000 amount as gross receipts or sales (net of returns and allowances) on the entity’s Form 1120, Form 1120-S, Form 1065, or other applicable IRS form.

Note that the second bullet requires a physical operating presence. Reporting criteria require that the address listed for the company must be a physical address and cannot be the address of the registered agent.

One other consideration is what to do if the status of the company changes. If an entity initially files a report and subsequently becomes exempt, the company should file an updated report indicating that it is no longer a reporting company. These abbreviated reports will only require that the entity identify itself and check the box indicating the newly exempt status.

In the event a previously exempt company no longer meets the exemption criteria, BOI reporting will be required, apparently with a 30-day deadline. Entities that are no longer exempt are subject to the special rule of 31 CFR 1010.380(a)(1)(iv), which requires them to file a report within 30 days of ceasing to be exempt. If this subsequent exemption happens during the first year after the effective date, it seems the entity will benefit from the longer of the two applicable time frames (i.e., the remaining days in the one-year filing period or the 30-day calendar period.)8

Unauthorized Practice of Law

One of the hottest issues surrounding the CTA reporting program is whether consulting or providing services related to the CTA rises to the practice of law. In a February Texas State Board Report, the General Counsel to the Board addressed the issue as to whether preparation of BOI is the practice of law and deferred to the Texas State Bar Association.

Given the potential risk, many firms are taking the position of not providing any services or advice related to the CTA, and some have stated so explicitly via published guidance.9 Many legal firms are reluctant to do reporting or offer services in this area, with some expressing the expectation that CPAs will do the reporting.

Furthermore, whether insurance companies are willing to cover any liability related to CPAs, practicing in the CTA area varies by provider. While some insurance companies are refusing to cover any liability related to CPAs practicing in this area, other companies have clarified that such practice is covered. For example, Berkley Select, the carrier for TXCPA’s Member Insurance program, and CNA, the carrier for AICPA’s member insurance program, will generally cover services related to CTA, at least as to work performed prior to a determination that it constitutes the unauthorized practice of law.10 CPAs should check with their carrier.

There are a number of entities, including several existing national corporate services firms, that have surfaced offering apparently very cost-effective services for the preparation of BOI forms, for existing entities as well as newly formed entities. Although a potential alternative, caution should be advised given the typical transactional nature of such a relationship. Meeting reporting requirements does not relieve the responsible party from meeting any follow-up requirements.

CPAs should note that actually filing organizational documents, aside from the risk that may constitute the unauthorized practice of law, now exposes the organizer of liability for failure to file the BOI report.

Legal Challenges

On March 1, 2024, a federal judge in the U.S. District Court for the Northern District of Alabama held the CTA to be unconstitutional.10 The ruling, however, may only apply to the plaintiffs in the case.

Following the decision, FinCEN announced it would not enforce the CTA specifically against the plaintiffs, and that only those individuals and entities are not required to report BOI at this time. We understand that as of March 13, 2024, the government has appealed the decision. Developments in this connection may take considerable time to resolve the issues.

Call to Action

Even if not responsible for BOI filings or related services, CPAs may wish to serve their clients by keeping their existing client base informed. In this context, CPAs should monitor any changes to guidance and should actively relay this information to their clients. Given potential liability, this is probably a good time for firms to revisit and discuss both their professional and general liability policies with their provider.

On the legal front, practitioners should continue to follow the law and not depend on the lower court ruling. It took 21 months for the national case to be decided at the district court level and the appeals process will take many more months. Noncompliance with the CTA opens up a reporting company to the stiff monetary penalties of $591 a day (effective January 25, 2024)11, up to $10,000 plus potential criminal charges.

Related CPE Webcasts

- The Corporate Transparency Act – What You Need to Know to Protect Your Client

- Surgent’s Guide to the Corporate Transparency Act for Accounting and Finance Professionals

- 2024 Corporate Transparency Act Developments and Proposed FinCen Reporting Requirements for Real Estate Sellers

Go to the Education area of the TXCPA website and search Corporate Transparency Act to learn more and register

About the Authors:

Kenneth M. Horwitz, CPA, JD, LLM, is a Partner with the law firm of Glast, Phillips & Murray, P.C. in Dallas, Texas. Contact him at kmh@gpm-law.com.

Nathan S. George, CPA, is a Tax Manager with Condley and Company, LLP in Abilene, Texas. Contact him at nathan.george@condley.com.

Footnotes

2. Beneficial Ownership Information Reporting: Frequently Asked Questions, H.2. Accessed from https://www.fincen.gov/contact.

3. Beneficial Ownership Information Reporting: Frequently Asked Questions, B.1. Accessed from https://www.fincen.gov/boi-faqs.

4. https://boiefiling.fincen.gov/fileboir

5. https://www.fincen.gov/contact

6. BOI Reporting Requirements: Small entity compliance guide, p. 9. Accessed from https://www.fincen.gov/boi/small-entity-compliance-guide.

7. Friedlich, M. Most small accounting firms are subject to the Corporate Transparency Act’s BOI reporting rules. Accessed from https://www.wolterskluwer.com/en/expert-insights/most-small-accounting-firms-are-subject-to-the-corporate-transparency-acts-boi-reporting-rules.

8. 31 CFR Part 1010, RIN: 1506-AB49.

9. WhitleyPenn. Corporate Transparency Act filing requirements begin in 2024. Accessed from https://www.whitleypenn.com/corporate-transparency-act-filing-requirements-begin-in-2024/?hss_channel=lcp-36777.

10. Waggoner, M. Federal court holds Corporate Transparency Act unconstitutional. Accessed from https://www.journalofaccountancy.com/news/2024/mar/federal-court-holds-corporate-transparency-act-unconstitutional.html. See National Small Business United v. Yellen, Case No. 5:22-cv-1448-LCB (US Dist. N.D.Ala. 3/1/2024).

11. https://federalregister.gov/d/2024-01420

Thanks to the Sponsors of Today's CPA Magazine

This content was made possible by the sponsors of this issue of Today's CPA Magazine: