July 01, 2024

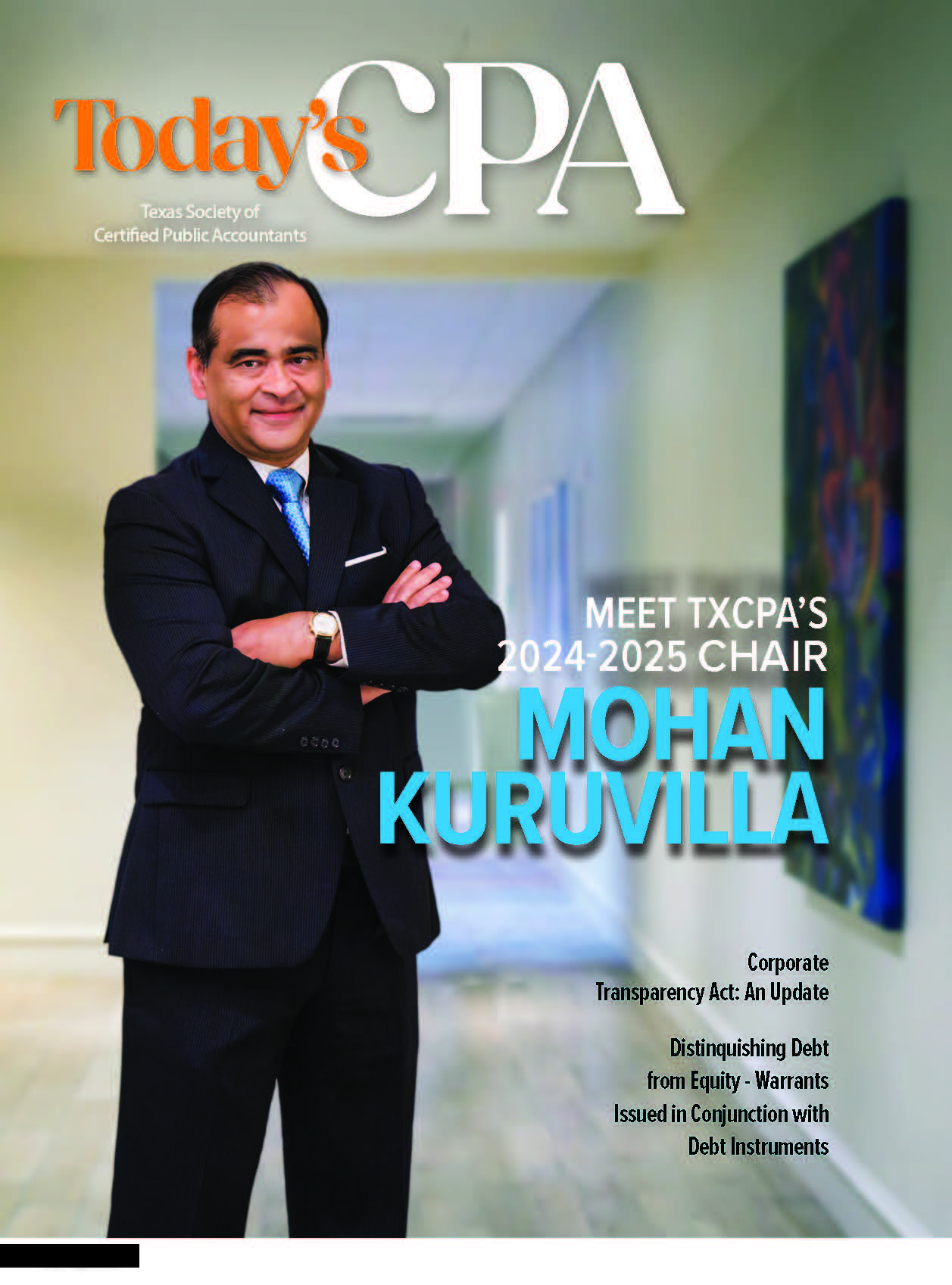

Introducing Our New Chair, Mohan Kuruvilla

TXCPA's 2024-2025 Chair Has a Comprehensive Vision for Advancing the Accounting Profession

By TXCPA President and CEO Jodi Ann Ray, CAE

TXCPA Chair Mohan Kuruvilla, Ph.D., CPA-Houston, is the Senior Professor of Practice, Director of the MSACCY Program at the Bauer College of Business, University of Houston. He oversees specialized accounting tracks at both undergraduate and graduate levels and teaches accounting courses in the MBA program and Auditing courses at UH Bauer College. He is also a Director of Datatracks Inc, one of the leading providers of XBRL services to U.S. public companies and other entities around the world. TXCPA President and CEO Jodi Ann Ray, CAE, recently talked with him about his career path, his roles in education and community service, and his goals this year as TXCPA Chair.

Career Journey

Mohan was born into a family of accountants and always knew he would become a Chartered Accountant (the equivalent of a CPA under the British system). In fact, his dad was a Gold medalist, securing the top score in his year for the Chartered Accountancy Exam. As for Mohan’s own Chartered Accountancy Exam? “I just passed it - no such achievement!”

After working as a Chartered Accountant in India for three years, he moved to the U.S. to complete his MBA in finance and Ph.D. in accounting. During this time, he passed the CPA Exam and began his academic career at the Bauer College of Business.

A couple of years later, he joined a Big 4 accounting firm as a Director, gaining exposure to audit clients and IPO working groups. After four years, he returned to academia, becoming a Professor and Dean of the Business School at Houston Christian University (formerly Houston Baptist University). After six years as Dean, he wanted more time in the classroom and transitioned back to Bauer College of Business, where he now teaches and directs the STEM-designated M.S. in Accountancy program.

Mohan finds teaching to be very rewarding, seeing the impact on young minds and staying connected with former students even after 20 years, who often share how he has influenced their careers. He said it is a joy seeing the progress they have made in their professional life.

Trends in Accounting Education

Mohan noted that while accounting education has evolved over time, there is still much progress to be made. He highlighted the growing emphasis on data analytics and predicted a shift towards AI and tech-enabled processes in the future. He stated: “We need to reimagine accounting education to better prepare our students for the professional world of tomorrow.” Emphasizing critical thinking is essential for success. Students will need to advance the knowledge hierarchy; for example, focusing more on evaluation than just application.

Addressing Accounting Pipeline Issues

The talent shortage faced by so many professions is also hitting accounting. The 22-member National Pipeline Advisory Group (NPAG) is committed to developing an extensive strategy that addresses stakeholder needs, utilizes unbiased research and drives change. Representing TXCPA, President and CEO Jodi Ann Ray is part of this group. Their solutions aim to simplify CPA licensure and provide flexibility for diverse candidates.

One NPAG recommendation is to make accounting education more engaging. Mohan agrees and suggests that impactful change can begin by incorporating experiential learning into the classroom. This requires partnerships between academic institutions and employers.

For example, auditing classes cover auditing theory and students engage in projects. Mohan believes it would be much more impactful if employers were in the classroom with live projects that could be assigned with close supervision. This collaboration would allow employers to educate and identify talent simultaneously. “Closer partnerships between colleges and employers, with active engagement in class content, are essential,” Mohan said.

NPAG also highlighted the need for a revamped approach to the Principles of Accounting course. Mohan concurs with this, as well, highlighting an urgency for change. He has observed that students often find the introductory principles class uninspiring. This foundational course, mandatory for all business majors, ought to undergo restructuring to offer a broad perspective on the pivotal role accounting plays in business and the many career paths that are available as a CPA.

Mohan advocates for the course to actively promote the accounting profession to students. He suggests that dynamic and enthusiastic professors spearhead these classes, sharing their passion and energy. “I had a recent conversation with a professor who pointed out that in some institutions, there are very tenured professors who have been teaching Principles of Accounting the same way with the same teaching materials for decades. It’s time for a shift in approach.”

A more effective approach to the course might involve a dual focus. The initial segment would address what the accounting profession is all about and its myriad opportunities. The latter part would introduce the financial statement, what it means and how to use it as a tool. “Then, work backwards to help students understand how the financial statements are created and what principles you need to understand to help guide businesses and financial decisions. Under the current approach, instead of selling them on the value and importance of accounting, we are driving them away.”

STEM Designation

The C.T. Bauer College of Business’s Master of Science in Accountancy (MSACCY) has been granted STEM designation by the Texas Higher Education Coordinating Board, marking it as an official science, technology, engineering, and math program. This designation holds significant implications for the accounting profession, particularly in helping to address pipeline challenges.

Mohan stressed the importance of this designation: “Currently, our MSACCY program stands as the sole STEM-designated program, a factor that holds considerable appeal for international students. This designation extends their Optional Practical Training (OPT) period from one year to three, providing ample time for them to gain invaluable experience and training, allowing both students and employers to assess their compatibility for continued employment.” For firms with locations in the students’ home countries, the transition post-OPT becomes a seamless progression.

In addition, securing STEM designation for accounting at the K-12 level holds promise in integrating the profession into educational curricula alongside established STEM fields like engineering and medicine. This exposure ensures that students are introduced to accounting concepts early in their academic path, potentially steering them towards careers in the profession. The STEM designation also opens avenues for accessing federal funding.

Challenges and Opportunities Ahead

Since addressing the talent shortage and shrinking pipeline are such critical concerns, Mohan said that TXCPA has been at the forefront of proposing solutions to tackle the issue head-on. Proposals aimed at reducing barriers to entry into the profession have been spearheaded by TXCPA, with a recent bill facilitating CPA Exam eligibility after completing 120 credit hours, effective September 1, 2023. However, this is just a starting point. Further action and solutions are needed.

Mohan pointed out that despite the evolving landscape, starting salaries within the profession, particularly in public accounting, have failed to match the pace of inflation over the past two decades. Recently, there have been indications of progress in this regard, with some firms demonstrating movement in the right direction.

He believes there is a pressing need to reshape the perception of accounting among young students. The profession is undergoing significant disruption, leading to an expansion in the scope and diversity of services offered. Consequently, educational approaches must adapt to these changes to remain relevant and effective in preparing future CPAs.

He said that some CPAs are also concerned about how AI is going to impact the profession, but he sees this is an opportunity to increase the value-added services a CPA can provide by leveraging technology.

Objectives and Priorities

In his role as TXCPA Chair for 2024-2025, Mohan has outlined several key objectives and priorities for the organization. He emphasizes the importance of continuous learning, stressing the need for current CPAs to engage in reskilling and relearning. To facilitate this, TXCPA offers continuing education opportunities through timely and relevant CPE courses geared towards preparing professionals for the increasingly technology-driven landscape. Additionally, Mohan envisions a robust leadership development program, delivered collaboratively with TXCPA chapters, that spans the entire state.

More work also needs to be done on addressing the pipeline issue and aligning TXCPA’s efforts with AICPA and NPAG. This involves expanding outreach to more high school students and forging partnerships with investment clubs in high schools to enable a coordinated approach to attract talent into accounting and finance.

A Life of Sports, Music and Global Adventures

In his time away from work, Mohan enjoys playing racquetball, a sport he has passionately pursued for many years. His dedication to the game has yielded notable achievements, including clinching the gold medal in Texas for the 50+ age category in both 2018 and 2019. Additionally, Mohan has recently ventured into playing padel tennis.

Beyond sports, Mohan’s interests extend to music, having played violin from around the age of eight. An avid traveler, he loves to explore diverse cultures, with visits to more than 24 countries across the globe.

Leading TXCPA in 2024-2025

As we begin the new year, we are excited to welcome Mohan’s leadership as TXCPA Chair. With a background spanning academia, industry and community service, he is well-equipped to guide us through the transformative change that lies ahead.

Mohan’s primary goals for the upcoming year revolve around tackling key challenges facing the accounting profession, including talent shortages and educational alignment with industry needs. His dedication to excellence positions him as a dynamic leader poised to guide TXCPA towards future growth and success.

Mohan’s primary goals for the upcoming year revolve around tackling key challenges facing the accounting profession, including talent shortages and educational alignment with industry needs. His dedication to excellence positions him as a dynamic leader poised to guide TXCPA towards future growth and success.

About the Author: Jodi Ann Ray, CAE, is TXCPA's President and CEO. Contact her at jray@tx.cpa.

| Key Facts About Mohan Kuruvilla, Ph.D., CPA-Houston |

|---|

| Senior Professor of Practice, Director of MSACCY Program at the University of Houston |

| Responsible for specialized accounting tracks at undergraduate and graduate levels |

| Teaches in the MBA program and Auditing courses at UH Bauer College |

| Former Dean of the School of Business and Professor at Houston Baptist University for 6 years |

| Former Director at KPMG for 4 years |

| Certified Public Accountant (CPA) and Chartered Accountant (CA) |

| Holds an MBA in Finance and a Ph.D. in Accounting from the University of Houston |

| Past President for TXCPA Houston |

| Independent board member for Taurus Quest Limited and Data Tracks Limited |

| Involved with non-profit organizations, including the Board of Asian American Family Services and Indo-American Charity Foundation |

| Published and interviewed on various business issues; extensive consulting experience in the U.S. and globally |

Thanks to the Sponsors of Today's CPA Magazine

This content was made possible by the sponsors of this issue of Today's CPA Magazine: