March 05, 2024

CPE Article: Incentive Compensation Clawback, SEC’s New Promulgation

By Josef Rashty, CPA, Ph.D. (Candidate)

~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~

CPE Self Study Article & Quiz

Register to gain access to the self-study quiz and earn one hour of continuing professional education credit by passing the quiz.

~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~

CPE Hours: 1

Curriculum: Accounting Technical

Level: Basic

Designed For: CPAs in industry and public practice

Objectives: To provide a summary of the new SEC promulgation for incentive compensation clawback rules and describe the accounting implications of 17 CFR §240.10D-1, Listing Standards Relating to Recovery of Erroneously Awarded Compensation

Key Topics: Clawback policies; executive officers who are subject to clawback; incentive compensation and financial measures; financial statements subject to restatement; tax implications; and changes and corrections identified in ASC 250

Prerequisites: None

Advanced Preparation: None

~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~

On July 21, 2010, President Barack Obama signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act, which deals with numerous aspects of corporate governance – including executive compensation. The Dodd-Frank Act modified and improved on the executive compensation and clawback provisions of Section 304 of the Sarbanes-Oxley Act of 2002.

A summary of 2010 Dodd-Frank Act’s clawback provisions is as follows:

- Its scope is to provide for accounting restatement due to material noncompliance with any financial reporting requirements under securities laws;

- It provides for the erroneously awarded incentive-based compensation (including stock awards) in excess of the amount that companies would have paid under the accounting restatement;

- It applies to all current and former executive officers rather than CEOs and CFOs;

- It covers the past three years.

In October 2022, the SEC promulgated the final clawback rule (Rule or the Rule) that Section 954 of the Dodd-Frank Act mandated. The Rule added Section 10D to the Securities Exchange Act of 1934. The final rule directs U.S. stock exchanges and securities associations to adopt listing standards requiring all listed companies, including foreign private issuers, emerging growth companies and smaller reporting companies, to adopt and comply with a written clawback policy.

However, the author expects changes and modifications to the clawback rules. Thus, Today’s CPA will monitor these changes and inform its readers of any new developments in the coming year.

This article summarizes the new SEC promulgation for incentive compensation clawback rules and expounds on the accounting implications of 17 CFR §240.10D-1, Listing Standards Relating to Recovery of Erroneously Awarded Compensation. This article benefits most public business entities (PBEs) registered under Section 6 of the Securities Exchange Act of 1934 and voluntarily to all privately held companies. This article incorporates an example of clawback of stock awards and cash bonuses to an executive of a company due to the restatement of financial statements.

Clawback Policies

An issuer triggers a clawback process if it determines the need to restate previously issued financial statements due to material noncompliance. The clawback policy must require companies to recoup any equity or cash compensation award that they have paid to any current or former Section 16 officer under the following circumstances:

- If they have calculated the incentive compensation based on restated financial statements due to material noncompliance with financial reporting requirements, without regard to any fault or misconduct;

- If the above noncompliance has resulted in an overpayment of incentive compensation within the preceding three fiscal years.

The SEC requires that issuers comply with the following:

- Filing copies of their clawback policy as an exhibit to their Form 10-Ks.

- Disclosing the amount of compensation recovery if there are restatements.

Registrants may be subject to delisting if they do not comply with the SEC guidance.

Executive Officers Subject to Clawback

Regulation 10D-1 has intentionally adopted a broad definition of “executive officer” and modeled it after the Securities Exchange Act of 1934 in Rule 16a-1(f). Under the final rule, executive officers include the registrant’s president, principal financial officer, principal accounting officer (if the issuer does not have one, the controller), vice presidents in charge of business units or divisions, and any officer who performs policy-making decisions.

Companies’ recovery policy of incentive compensation is not “fault-based;” thus, the registrants should recover any paid incentive-based compensation regardless of the fault of executive officers. The rule does not require the direct involvement of the officer in the occurrence of the accounting error that triggers the recovery policy.

Incentive Compensation and Financial Measures

Incentive compensation subject to clawback policy includes any equity-based (within the scope of ASC 718, Compensation – Stock Compensation) or cash-based incentive compensation (within the scope of ASC 710 Compensation – General) that the registrant has granted, earned or vested – based completely or partially upon the attainment of financial reporting measures.

The incentive compensations subject to SEC promulgation are as follows:

- Cash awards;

- Restricted stocks;

- Restricted stock units (RSUs);

- Performance-based restricted stock units (PSUs);

- Stock options (incentive or non-qualified);

- Stock appreciation rights (SARs).

Incentive compensation excludes base salary, time vesting and cash awards not based on achievement of financial accounting measures. The incentive compensation employees have received during the preceding past three completed fiscal years is subject to the SEC’s clawback provisions.

The following are not all-inclusive examples of the SEC’s financial measures in its final rule:

- Revenues;

- Net or operating income;

- Earning measures (e.g., earnings per share);

- Financial ratios (e.g., accounts receivable turnover and inventory turnover rates);

- Non-GAAP measures (e.g., EBITDA and adjusted EBITDA).

Financial Statements Subject to Restatement

The SEC defines financial statements as any of the following that it requires as part of the 10-Qs and 10-Ks filings:

- Statement of financial position (commonly referred to as balance sheet);

- Statement of comprehensive income;

- Statement of cash flows;

- Statement of stockholders’ equity;

- Related schedules;

- Accompanying footnotes.

U.S. Stock Exchanges

The NYSE and NASDAQ amended their proposed clawback listing standard to provide October 2, 2023, as the effective date and as a result, companies had until December 1, 2023, to adopt their clawback policies.

Registrants are subject to delisting from their national security exchange and may not apply for relisting on a different U.S. Stock Exchange before compliance with their clawback policy that Rule 10D-1 requires.

Errors and Corrections

ASC 250, Accounting Changes and Error Corrections, identifies the changes and corrections included in Table 1.

| Table 1. Changes and Corrections Identified in ASC 250 | |

| Accounting principle | A change from one generally accepted accounting principle to another generally accepted accounting principle. It applies to two types of changes: Mandatory changes required by a newly issued; or Voluntarily changes from one acceptable accounting principle to another based on preference. |

| Accounting estimates | A change that adjusts the carrying amount of an existing asset or liability or alters the subsequent accounting for existing or future assets or liabilities. |

| Reporting entity | A change in reporting entity is generally limited to the following types of changes: Presenting consolidated or combined financial statements in place of financial statements of individual entities; Changing specific subsidiaries that make up the group of entities for which consolidated financial statements are presented; and Changing the entities included in combined financial statements. |

| Correction of an error in previously issued financial statements | An error in recognition, measurement, presentation or disclosure in financial statements resulting from mathematical mistakes, mistakes in the application of GAAP, or oversight or misuse of facts that existed when companies prepared those financial statements. |

Out-of-Period Adjustments

Companies can correct an error within the current period as an “out-of-period adjustment” when it is immaterial to both the current and prior period(s). Companies are not required to disclose immaterial out-of-period adjustments. However, there are circumstances that the out-of-period adjustment stands out (e.g., it appears as a reconciling item in the roll-forward of an account balance) that may warrant consideration of disclosure about the item’s nature.

Restatement of Financial Statements

The restatement can occur due to “Big R” or “little r.” Reporting the correction of the error(s) depends on the materiality of the error(s) to both the current period and prior period financial statements. Companies can correct the errors by restatement through one of the following methods:

- “Big R Restatement” – Companies can correct an error through a “big R restatement” (also referred to as re-issuance restatements) when the error is material to the prior period financial statements and requires filing of Form 8-K. A Big R restatement requires the entity to restate and reissue its previously issued financial statements to reflect the correction of the error.

- “Little r restatement” – Companies can correct an error through a “little r restatement” (also referred to as a revision restatement) when the error is immaterial to the prior period financial statements. However, correcting an error in the current period may materially misstate the current period financial statements (e.g., this often occurs due to an immaterial error that has been uncorrected for multiple periods and has aggregated to a material number within the current year). Under this approach, the entity would correct the error in the current year comparative financial statements by adjusting the prior period information and adding disclosure of the error. Companies usually do not need to file Form 8-K for their “little r restatements.”

Tax Implications

Companies calculate the amount of clawback recovery on a pre-tax basis (i.e., they do not subtract the portion of the taxes that executive offices had paid in taxes). Collecting clawback compensation on a pre-tax basis can be punitive in some cases – particularly if the executives are in high tax brackets. Companies may consider providing some protections in their grant agreements to minimize the impact of the taxes in case of any clawback event. For example, companies may allow the executive officers to defer a portion of their incentive compensation to hedge against a potential future clawback.

Effective Date

The final rule became effective on October 11, 2022. Compliance with the final rule is required in proxy and information statements that require executive compensation disclosures (under Item 402) for fiscal years ending on or after December 16, 2022.

The final rule requires five years of pay versus performance disclosures in a tabular format. However, for purposes of transition, registrants will only be required to include information for the three most recently completed fiscal years in the first year of compliance (two years for small reporting companies), with an additional year of information required in each following year to phase-in to the full five-year (or three-year for small reporting companies) tabular disclosure.

Latest Development

In 2022, the SEC adopted rules and directed U.S. securities exchanges to establish standards to require listed issuers to develop and implement a written policy providing for the recovery of incentive-based compensation received by current and former executive officers if there are accounting revisions and restatements.

The listing standards have been approved and took effect on October 2, 2023. However, companies will have until December 1, 2023, to adopt a compliant recovery policy. Companies must also apply their recovery policy to erroneously awarded compensation received on or after October 2, 2023. For annual reports filed after adopting a recovery policy, companies must file their policy as an exhibit and disclose any actions taken under the policy. Additionally, companies will need to indicate on the cover page of Form 10-K (or Form 20-F) whether the financial statements included in the filing reflect the correction of an error and whether the error correction required an incentive-based compensation recovery analysis.

Illustration

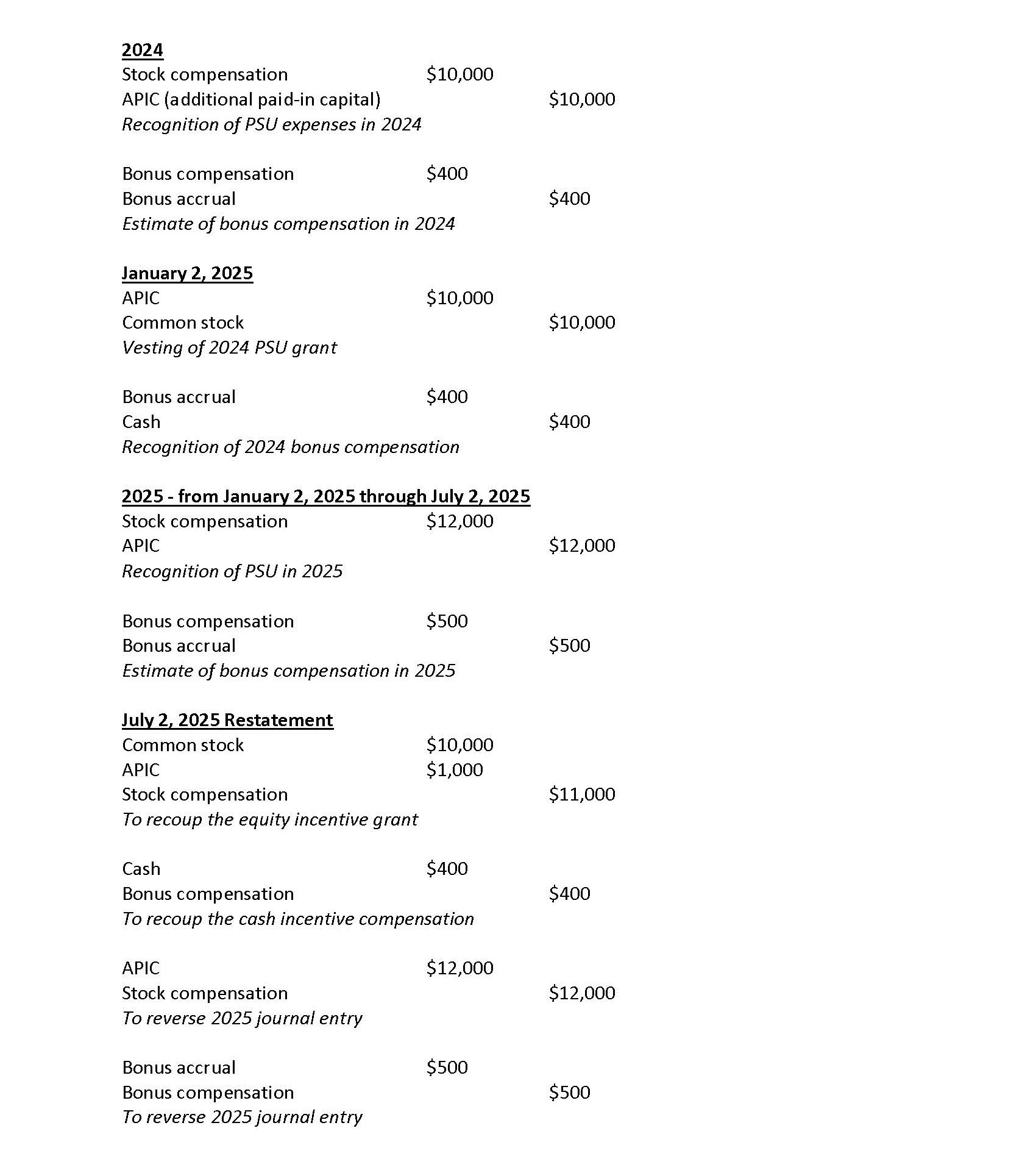

Entity A enacts the following incentive compensation plan for its chief marketing executive on January 2, 2024, if she can meet the revenue metrics at the end of the grant’s first-year anniversary:

1. It grants 1,000 PSU (performance-based stock units) at $10 per share vested in one year.

2. It awards $400 cash bonus payable at the end of the first-year grant.

The executive meets her incentive compensation goal on January 2, 2025, and receives the stock grant and stock compensation.

Entity A establishes the following incentive compensation plan for 2025 since the executive met her incentive compensation goal in 2024:

1. It grants an additional 1,000 PSU at $24 per share vested in one year.

2. It awards $1,000 cash bonus payable at the end of the first-year grant.

On July 3, 2025, Entity A encounters a material error in its previously published financial statements that requires “Big R restatement.” Thus, it issues a Form 8-K to disclose the forthcoming restatement. The announcement causes the stock to plunge to $11 per share. Entity A recoups the stock and cash incentive compensation to its executive.

The journal entries for the above transaction are as follows (ignoring the tax implication).

This example reflects clawback of 2024 equity and cash incentive compensation and the retraction of unvested 2025 equity and cash incentive compensation grant.

Clawback Rule

Clawback is the recoupment of incentive-based compensation that executive officers have received based on erroneous data – an amount over what they should have obtained based on the restated financial statements. This difference is the “recoverable amount” subject to clawback rules. The SEC’s clawback rule requires issuers to recoup excess compensation for the preceding three fiscal years regardless of whether an executive officer was involved or responsible for the restatement.

The SEC mandate also requires an issuer to disclose its recovery policy in an exhibit to its Form 10-K. Under the SEC’s final rule, both “Big R” and “little r” restatements trigger an analysis of whether companies need to claw back any executive incentive compensation. Companies need to review their existing clawback policies and employment agreements while planning to implement this rule.

This rule mainly applies to the SEC registrants; however, many private companies may voluntarily adopt the rule for several reasons – in particular, privately held companies preparing for an initial public offering (IPO) or are planning for one in the future.

About the Author: Josef Rashty, CPA, Ph.D. (Candidate) is a member of the Texas Society of CPAs and provides consulting services in Silicon Valley, California. He can be reached at j_rashty@yahoo.com.