November-December 2021

In this issue:

- Tax Planning Around Changing Charitable Contribution Law

- 2021 Rising Stars

- The SEC Updates Regulations to Streamline and Enhance Management Discussion & Analysis

- Helping Auditors Add Critical and Key Audit Matters to Audit Reports

- Recognizing Our Rising Stars

- Enhancing the Value of SOC Reports During a Pandemic

-

Tax Planning Around Changing Charitable Contribution Law

This article focuses on recent tax law changes that dramatically reduced the number of taxpayers who itemize. It then examines the level of charitable giving, possibly in anticipation of the changes in the tax law related to itemized deductions.View Article -

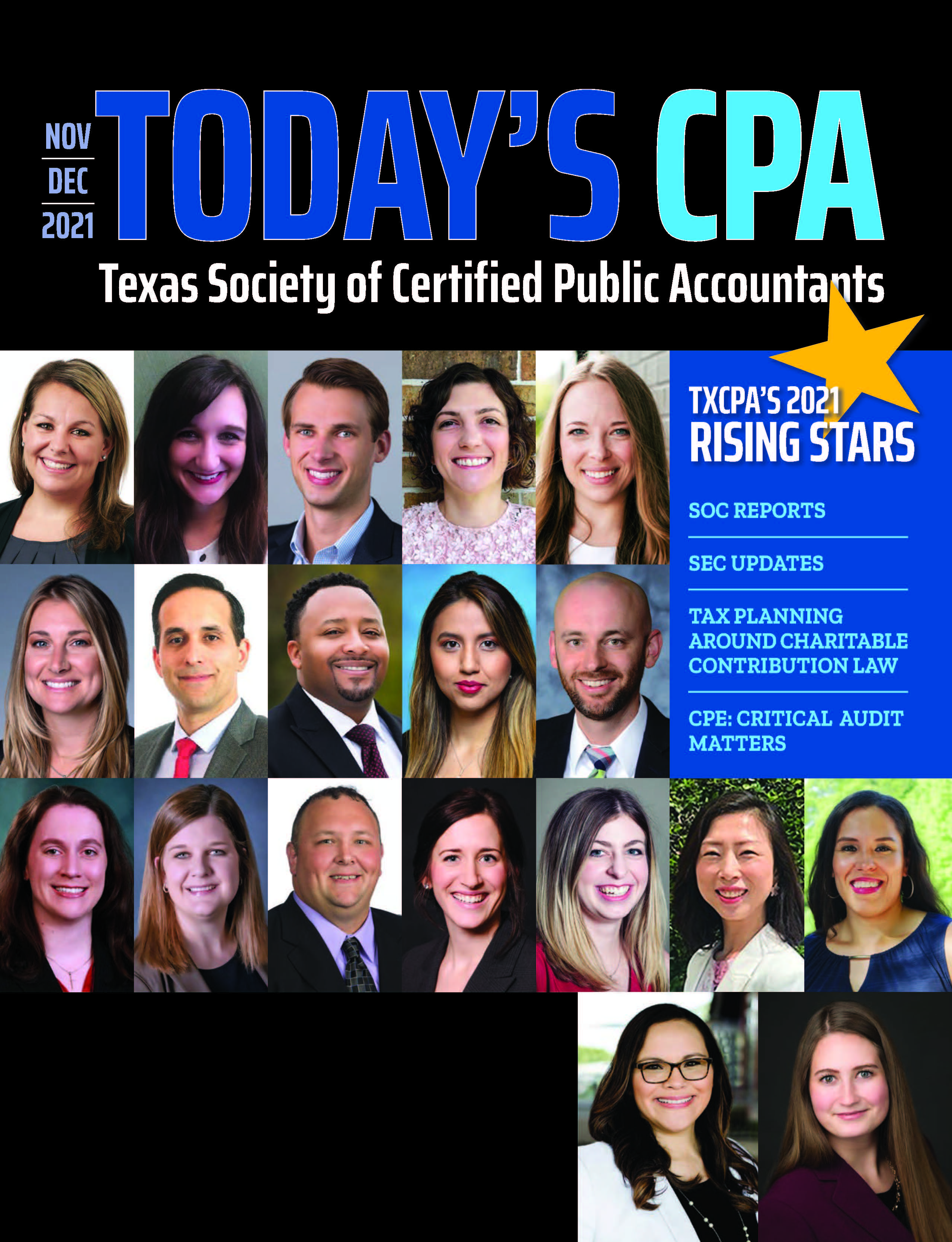

2021 Rising Stars

Through the Rising Stars Program, TXCPA recognizes CPA members 40 years old and younger who have demonstrated significant leadership qualities and active involvement in TXCPA, the accounting profession and/or their communities. A TXCPA selection committee named the following 19 up and comers based on their contributions to the accounting profession and their communities. We are excited to introduce you to the members, in alphabetical order, who are the Rising Stars honorees for 2021.View Article

-

The SEC Updates Regulations to Streamline and Enhance Management Discussion & Analysis

The SEC has issued amendments to Regulation S-K to update information that is required to accompany the financial statements and supplemental disclosures in the quarterly 10-Q and annual 10-K. These revisions are intended to eliminate duplicative reporting and reflect the increased accessibility to financial filings available electronically.View Article -

Helping Auditors Add Critical and Key Audit Matters to Audit Reports

Communicating Key Audit Matters in the Independent Auditor’s Report was adopted in several countries. This standard requires key audit matter (KAM) disclosure for listed companies, or when required by a specific law or regulation.View Article

-

Recognizing Our Rising Stars

When reading their profiles, we know you’ll see the many reasons these 19 members were recognized as up and comers in TXCPA, the accounting profession and their communities.View Article -

Enhancing the Value of SOC Reports During a Pandemic

As businesses and their service organizations adapt to the realities of the pandemic, they can use a System and Organization Controls (SOC) report as a critical communications tool to maintain and strengthen overall operations.View Article

CHAIR

Mohan Kuruvilla, Ph.D., CPA

PRESIDENT/CEO

Jodi Ann Ray, CAE, CCE, IOM

CHIEF OPERATING OFFICER

Melinda Bentley, CAE

EDITORIAL BOARD CHAIR

Jennifer Johnson, CPA

MANAGER, MARKETING AND COMMUNICATIONS

Peggy Foley

pfoley@tx.cpa

MANAGING EDITOR

DeLynn Deakins

ddeakins@tx.cpa

COLUMN EDITOR

Don Carpenter, MSAcc/CPA

DIGITAL MARKETING SPECIALIST

Wayne Hardin, CDMP, PCM®

CLASSIFIEDS

DeLynn Deakins

Texas Society of CPAs

14131 Midway Rd., Suite 850

Addison, TX 75001

972-687-8550

ddeakins@tx.cpa

Editorial Board

Derrick Bonyuet-Lee, CPA-Austin;

Aaron Borden, CPA-Dallas;

Don Carpenter, CPA-Central Texas;

Rhonda Fronk, CPA-Houston;

Aaron Harris, CPA-Dallas;

Baria Jaroudi, CPA-Houston;

Elle Kathryn Johnson, CPA-Houston;

Jennifer Johnson, CPA-Dallas;

Lucas LaChance, CPA-Dallas, CIA;

Nicholas Larson, CPA-Fort Worth;

Anne-Marie Lelkes, CPA-Corpus Christi;

Bryan Morgan, Jr, CPA-Austin;

Stephanie Morgan, CPA-East Texas;

Kamala Raghavan, CPA-Houston;

Amber Louise Rourke, CPA-Brazos Valley;

Shilpa Boggram Sathyamurthy, CPA-Houston, CA

Nikki Lee Shoemaker, CPA-East Texas, CGMA;

Natasha Winn, CPA-Houston.

CONTRIBUTORS

Melinda Bentley; Kenneth Besserman; Kristie Estrada; Holly McCauley; Craig Nauta; Kari Owen; John Ross; Lani Shepherd; April Twaddle; Patty Wyatt