November 01, 2024

Mitigating Medicare Mistakes: The CPA’s Role in Navigating IRMAA Challenges

By Al Kushner

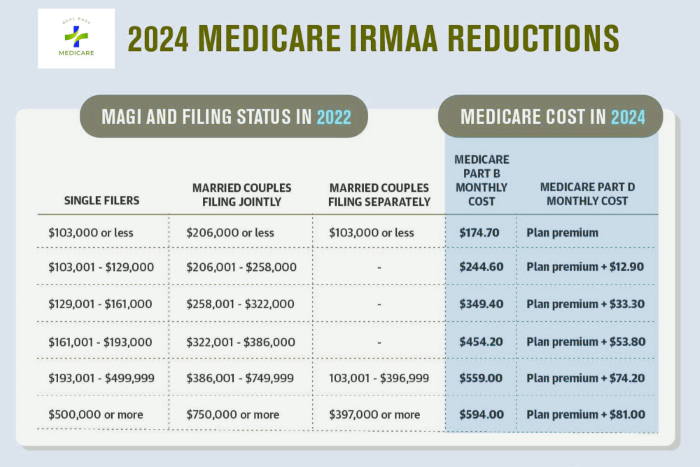

In the labyrinth of health care planning for retirement, one of the most complex challenges faced by individuals is understanding and navigating the Income-Related Monthly Adjustment Amount (IRMAA) associated with Medicare. IRMAA is an additional charge added to Medicare Part B and Part D premiums for individuals whose income exceeds certain thresholds. This can significantly impact the health care costs of higher income beneficiaries.

As CPAs, you are uniquely positioned to guide your clients through the financial intricacies of Medicare, helping them avoid costly mistakes related to IRMAA. Your expertise in tax planning and financial strategy can be a beacon of clarity for clients navigating these turbulent waters. Here’s how you can make a difference.

Understanding IRMAA

First and foremost, it’s essential to grasp the basics of IRMAA. IRMAA affects premiums for Medicare Part B (medical insurance) and Part D (prescription drug coverage). The Social Security Administration determines IRMAA charges based on the beneficiary’s Modified Adjusted Gross Income (MAGI) from two years prior. Consequently, a client’s financial decisions today can influence their Medicare costs tomorrow. Please see the following chart.

Strategic Income Planning

One of the most effective ways CPAs can assist clients is through strategic income planning. Since IRMAA is based on MAGI, optimizing income sources to stay below IRMAA thresholds can save clients thousands of dollars annually. For instance:

- Roth Conversions: Advising clients on the timing of Roth IRA conversions can spread out income recognition over multiple years, potentially avoiding spikes that could push them into higher IRMAA brackets.

- Tax-efficient Withdrawals: Guide your clients on which accounts to withdraw from first to manage their MAGI. Balancing withdrawals from taxable, tax-deferred and Roth accounts can help manage their taxable income levels.

- Investment Choices: Recommend investments that offer tax efficiency, such as municipal bonds or life insurance policies, which might not count towards MAGI.

Life-Changing Event Appeals

Life changes, such as retirement, marriage, divorce, or loss of income-producing property, can lead to a significant drop in income. However, the IRMAA determination may not immediately reflect this change since it is based on tax returns from two years ago. CPAs can guide clients in filing an appeal, known as a “Request for Reconsideration,” with the Social Security Administration to adjust their IRMAA based on their current financial situation.

Tax Planning and Reporting Accuracy

Accuracy in tax reporting is crucial for IRMAA determinations. Overstating income can inadvertently increase Medicare costs. CPAs play a vital role in ensuring that clients’ tax filings are precise, taking advantage of all eligible deductions and credits to accurately reflect their financial reality. This includes being meticulous about capital gains, distributions from retirement accounts and other income sources that contribute to MAGI.

Educating Clients on IRMAA

Education is perhaps one of the most critical roles CPAs can play. Many individuals are unaware of IRMAA until they receive their first elevated premium notice. By informing clients about how IRMAA works, the income thresholds and the potential for future increases, you empower them to make informed decisions about their retirement planning and health care strategy.

Collaborative Planning

Finally, consider adopting a collaborative approach by working with your clients’ other advisors, including financial planners and health care consultants. Such collaboration can ensure a cohesive strategy that aligns financial planning with health care needs, creating a well-rounded approach to retirement planning.

Closing Thoughts

Navigating the complexities of IRMAA requires a proactive approach, one where CPAs can significantly impact their clients’ financial and health care outcomes. By leveraging your expertise in tax planning and financial strategy, you can guide your clients away from costly mistakes and towards a future where health care costs are managed efficiently and effectively.

Remember, your role as a CPA isn’t just about numbers; it’s about improving your clients’ overall quality of life as they transition into retirement. By focusing on the nuances of Medicare and IRMAA, you provide invaluable peace of mind, reinforcing the trust and confidence your clients place in you.

These insights remind us of the pivotal role CPAs play in navigating the financial intricacies of health care planning. Through strategic income planning, accurate tax reporting and client education, you can help your clients avoid the pitfalls of IRMAA, securing their financial well-being and ensuring a smoother transition into the golden years of retirement.

About the Author: Al Kushner is an award-winning Medicare expert with over three decades of experience in healthcare finance, renowned for his ability to demystify the complexities of Medicare coverage for beneficiaries nationwide. His expertise spans Medicare Parts A through D, focusing on the Income-Related Monthly Adjustment Amount (IRMAA) and tax planning strategies to minimize healthcare costs. His dedication extends beyond professional achievements. An avid outdoorsman in his personal life, Kushner champions a healthy, active lifestyle as essential for maximizing retirement years. He can be reached at 888-810-9725.

About the Author: Al Kushner is an award-winning Medicare expert with over three decades of experience in healthcare finance, renowned for his ability to demystify the complexities of Medicare coverage for beneficiaries nationwide. His expertise spans Medicare Parts A through D, focusing on the Income-Related Monthly Adjustment Amount (IRMAA) and tax planning strategies to minimize healthcare costs. His dedication extends beyond professional achievements. An avid outdoorsman in his personal life, Kushner champions a healthy, active lifestyle as essential for maximizing retirement years. He can be reached at 888-810-9725.

Thanks to the Sponsors of Today's CPA Magazine

This content was made possible by the sponsors of this issue of Today's CPA Magazine: