Investing Directly Into Oil and Some of the Tax Consequences

Over the past 40 years, countries, industries and companies have explored replacing oil and gas with renewable energy sources. However, according to the U.S. Energy Information Administration, petroleum (36%) and natural gas (32%) still account for over two-thirds of energy consumption in the United States¹. Therefore, investments in oil and gas will continue to be attractive additions to a portfolio.

This article was written to give the reader information about investing directly into oil and the resulting tax consequences. Rather than describing these investments in general terms, the lead author made direct investments in the following four types of oil and gas assets to receive tax information from his brokerage accounts to create this case study:

- Oil and Gas Royalty Trusts;

- Crude Oil Exchange-Traded Fund (ETF) that does not issue a K-1;

- Crude Oil ETFs that issue K-1s;

- Oil and Gas Futures Contracts.

The tax consequences described in this case study are unique to the lead author and should not be considered directly applicable to the tax consequences of other people.

Currently, there are investments for commodities such as gold and silver (e.g., Sprott Physical Gold and Silver Trust Fund [CEF]), as well as uranium (e.g., Sprott Physical Uranium Trust Fund [SRUUF]). However, there are no investments in produced oil that is stored at some facility and is available for sale at some future date. Therefore, someone wanting to invest in physical oil must instead purchase assets similar to produced and stored oil. This can be done via investments in oil and gas royalty trusts, Crude Oil ETFs and oil futures contracts.

Oil and Gas Royalty Trusts – BP Prudhoe Bay

Oil and Gas Royalty Trusts own oil and gas that is currently in the ground and has yet to be produced. There are several royalty trust investment options; however, the lead author selected BP Prudhoe Bay Royalty Trust (BPT) for this case study partially because this trust involves oil that is produced in Alaska (a state that does not have state income tax). It is also one of the largest conventional oil and gas royalty trusts in the United States, with a market capitalization of more than $300 million2.

The lead author bought 1,000 units of BPT at a price of $4.0768 per unit on July 21, 2021, for an investment of $4,076.80. He received distributions related to (a) third quarter production of $69.43 on October 20, 2021, and (b) fourth quarter production of $581.17 on January 19, 2022. The questions are how much income to report in 2021 and what is the new tax basis in the royalty trust units?

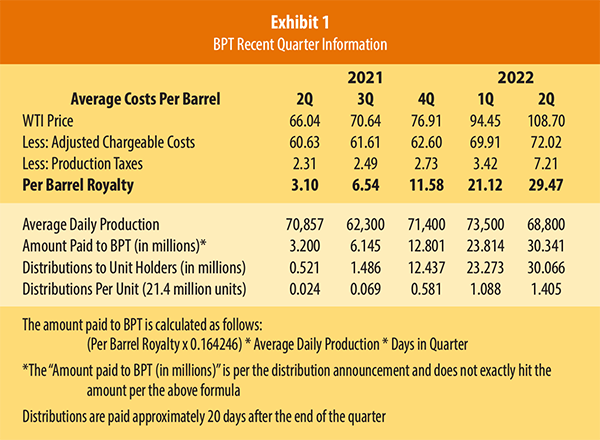

To address these questions, it would be beneficial to get a better understanding of BPT. The royalty trust was formed in 1989 and has an overriding royalty interest on 16.4246% of the lesser of the first 90,000 barrels of oil per day produced from the applicable working interest or the actual production of oil per day.

For the past 10 years, the actual production has been less than 90,000 barrels per day. The production levels for the past three years (ending September 30) were 73,800 barrels per day in 2019, 74,430 barrels per day in 2020, and 71,480 barrels per day in 20213. This reduced level of production has negatively impacted quarterly royalty payments. About a week after the quarter ends, BPT announces the quarterly royalty payment that it is going to receive, as well as the distribution that it will be making to Unit holders, if any (see Exhibit 1).

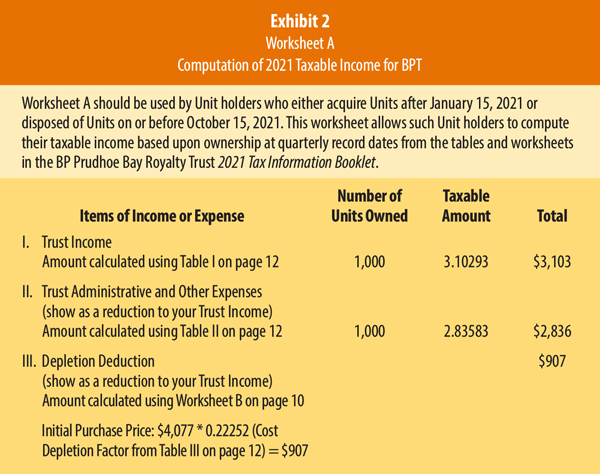

The amount of income to be reported by the lead author was computed by reference to the BP Prudhoe Bay Royalty Trust 2021 Tax Information Booklet. BPT is classified as a grantor trust. Therefore, unit holder taxable income depends on what BPT actually received in royalty payments, which can be different from the amount of the distributions. Related to the third quarter 2021 production, about two-thirds of the amount received by the trust was used to increase the trust’s cash reserve. That amount was still taxable to the unit holders, even though not received as a distribution for the year.

Following the directions in the BPT 2021 Tax Information Booklet, the gross income for the 1,000 units = $3,103, the Trust Administrative and other expenses = $2,836. Therefore, the net income was $267. There was also a deduction of $907 for cost depletion (see Exhibit 2). Thus, the net amount reported on Schedule E was minus $640. The amount deducted for cost depletion lowered the basis in the 1000 units by the same amount, so that the basis became $3,170.

What a difference a year makes! Due to low oil prices, there was no revenue from royalties related to any production in 2020. This led to a Going Concern paragraph being added to the KPMG audit report on the 2020 financial statements because the trust will terminate if net revenues from the royalty interest are less than $1,000,000 per year for two successive years4. However, for the past four quarters, BPT has received net revenue of at least $2,000,000 per quarter. In fact, for the second quarter of 2022, the net revenue received was about $24 million as oil prices surged over $100 per barrel.

The massive change in fortune is also reflected in the unit price. In October 2020, the price per unit was under $2.00 while as of early July 2022, the units were being traded at a price of about $20.00 per unit5.

OILK K-1 Free Crude Oil Strategy ETF

ProShares K-1 Free Crude Oil Strategy ETF (OILK) invests in financial instruments that ProShares Advisors believe should track the performance of the Bloomberg Commodity Balanced WTI Crude Oil Index. The fund invests in oil and gas futures contracts indirectly through its wholly-owned subsidiary, ProShares Cayman Crude Oil Strategy Portfolio.

The lead author entered 2021 with 400 shares of OILK. This consisted of 200 shares (split adjusted) bought on March 18, 2020 for $8,190.10 and 200 shares bought on December 10, 2020 for $8,347.00. He reduced his position to 175 shares by making four separate stock sales and then built back his position to 400 shares at the end of the year with an additional four separate purchases.OILK is the only oil ETF that is not a commodities partnership. Therefore, rather than reporting tax information on a K-1, they report tax information on a Form 1099. It is a regulated investment company that is registered under the Investment Company Act of 19406. The good news is that this investment distributes income in a timely manner, but the bad news is that the dividends are considered to be “Nonqualified” dividends.

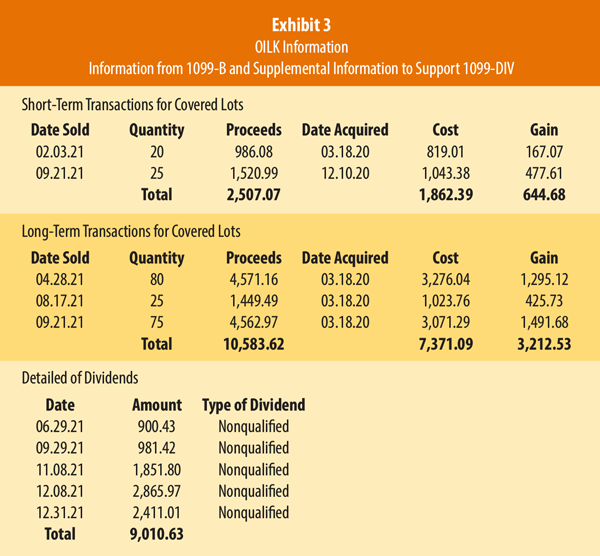

In this case, the four sales showed up on the 1099 information and there was no need for any tax basis adjustments. The tax information showed short-term capital gains of $644.68 and long-term capital gains of $3,212.53. The dividend information was also easily obtained. For the year, the total amount of dividends received from OILK was $9,010.63 of nonqualified dividends (see Exhibit 3).

The simplicity of OILK is greatly appreciated. Investments in so called commodity ETF partnerships are much more complicated to deal with at tax time. Overall, the OILK returns have been very volatile over the past few years. For the first half of 2022, the return was 44.94% and for the year ended June 30, 2022, was 57.05%. However, the return for the most recent five-year period was just 4.07% on an annualized basis7.

Oil and Gas ETFs – United States Oil Fund LP

United States Oil Fund LP (USO) invests primarily in near-term oil futures contracts. According to the December 31, 2020 annual report, the fund had 74,708 open commodity futures contracts, with 63,370 of them being for February 2021 through June 2021 WTI Crude Oil. According to the December 31, 2021 annual report, the fund had 32,136 open commodity futures contracts, with 27,106 of them being for February 2022 through June 2022 WTI Crude Oil.

The lead author entered the year with 625 shares of USO. During the year, he sold all 625 of these shares. He also purchased 146 additional shares and sold 116 of these shares by year end. He had 30 shares of USO remaining at the end of 2021.

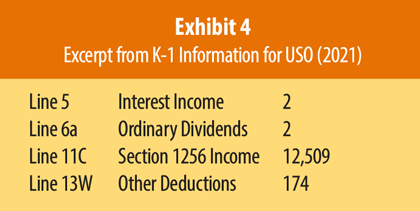

The tax treatment of his investment in USO for the year is handled with the help of the K-1 and supporting schedules that are provided by the fund. The K-1 indicates that he had income of 12,339 during the year. This was divided up into interest income (+2), dividend income (+2), Section 1256 income (+12,509), minus other deductions (-174). The K-1 directions indicated that the “other deductions” should be reported on Schedule E, line 28 (see Exhibit 4). Section 1256 gains are primarily from the sale of the oil futures contracts and are taxed as follows: 60% is taxed as a long-term capital gain and 40% is taxed as a short-term capital gain. These types of gains are reported on Form 6781.

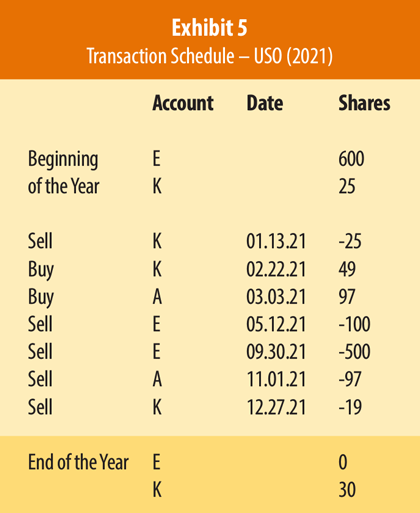

The fund provided a Transaction Schedule for the year that reported the beginning of year units of USO, as well as subsequent selling and buying activity. They combined all of the activity from various brokerage accounts in this schedule. For example, he had 600 units in his E account and 25 units in his K account at the start of the year. During the year, he sold these at various times. He bought and sold 97 units in his A account. He also bought 49 more units in his K account and sold 19 of these units as of the end of the year, leaving 30 units in this account (see Exhibit 5).

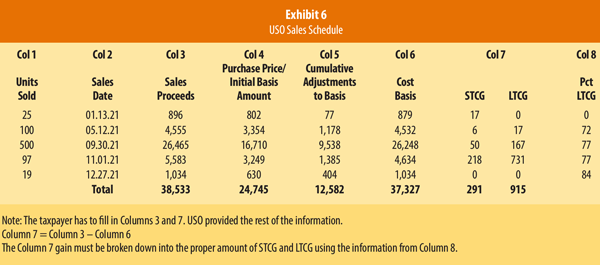

The fund also provides a Sales Schedule. The lead author looked up information from his brokerage accounts to put in Column 3 of the Sales Schedule worksheet. He then combined this information with the Initial Basis Amount (Column 4) and added to this the Cumulative Basis Adjustments (Column 5) to determine the overall gain for the year of $1,206 (see Exhibit 6).

The Cumulative Adjustments are necessary to make because as oil futures contracts are sold at a gain by the fund, the gain is passed through to the partner on Line 11C of the K-1 and increases the basis in his partnership interest. The Cumulative Adjustment kept the lead author from being taxed twice on this income.

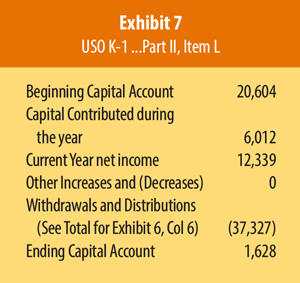

A key number is the total Cost Basis of units sold. This number ($37,327) agrees with the “Withdrawals and Distributions” amount shown in Part II, Item L of the K-1 because there were no cash distributions by USO during the year (see Exhibit 7). Another critical number in area L is Capital Contributed during the year (=$6,012), which equaled what he paid for units during the year as follows: 49 units purchased on Feb 22, 2021 for $2,010 and 97 units purchased on March 3, 2021 for $4,002. For 2021, he reported a capital gain of $1,206, which was broken down with the help of the supplemental information into a short-term capital gain of $291 and a long-term capital gain of $915. His remaining 30 units have a basis of $1,628 as of the end of 2021, which agrees with the ending capital account balance (see Exhibit 7).For the first half of 2022, the return of USO was 47.81% and the return for the year ended June 30, 2022 was 61.09%. However, the return for the most recent five-year period was just 1.12% on an annualized basis.

Oil and Gas 2X ETF – ProShares Ultra Bloomberg Crude Oil

ProShares Ultra Bloomberg Crude Oil (UCO) is an ETF that is designed to return twice the Bloomberg WTI Crude Index amount. Volatility, however, has a negative impact on the fund’s performance and can be as important as the change in the Bloomberg Index to the fund’s return.

As a leveraged fund, this investment is extremely risky. The Fund Prospectus and Supplement has several pages of capitalized and/or in bold print information about the risks of the fund.

Three especially important notes are as follows: the fund “seeks a return that is 2x the return of its index (target) for a single day,” “due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different than the target return,” and “investors should monitor their holdings as frequently as daily.”8

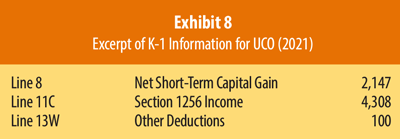

Like USO, the amount of income to report is reported on a K-1 and there is also a Transaction Schedule and a Sales Schedule. The lead author started out the year with 130 units and by the end of the year, he had just 20 units remaining. The K-1 told him to report $2,147 as a net short-term capital gain and to report Section 1256 income of $4,308. There is also a $100 deduction that he put on Schedule E, line 28 (see Exhibit 8).

UCO can be wonderful when oil prices go up and disastrous when they decline. The volatility of the Bloomberg WTI Crude Oil Index has averaged about 35% for the past five years. If the index increased by 30%, rather than receiving a 60% return, due to volatility the return would only be 49.5%. If instead the index decreased by 30%, the return would be -56.6%.

The fund has had good returns and disastrous returns. The worst of times was March 2020 when the fund lost 85.06%! It was down 92.86% for the year 2020. However, for the first half of 2022, the return was 92.94% and for the year ended on June 30, 2022, the return was 114.04%. Surprisingly, the annualized rate of return for the past five years ended on June 30, 2022 was -14.73%9.

UCO can be a fantastic investment. However, the investor should use extreme caution when using such a financial instrument. If someone was sure that oil was going up, then it would be a great investment. Unfortunately, no one is correct every time!

Oil and Gas Futures Contracts

A final option for investing directly in oil is by actually buying and selling oil and gas futures contracts. The lead author bought and then sold three contracts during the year, and then bought and still held at year end a fourth futures contract.

Before the lead author could trade futures contracts, the brokerage firm encouraged him to watch several related videos. He also had to sign a disclosure form saying that he understood the risks of investing in futures contracts (see the example).

The futures contracts were set up in a margin account by his broker. He only had to put 10% cash down for each contract. Each day, the account was marked to market value, and the difference increased or decreased the margin balance in a linked non-futures brokerage account.

He bought three contracts on Dec. 20, 2021. They were a standard 1,000 barrel contract for Dec. 22 Crude, a 100 barrel contract (called a Micro Contract) for Oct. 22 Crude and a 500 barrel contract (called an EMINI Contract) for Nov. 22 Crude.

He sold these contracts on December 27 and made a profit of $7,233.46. He then bought a standard 1,000 barrel contract for Dec. 23 Crude. At the time, the price of this oil was $65.35 per barrel. By year end, the contract was only worth $64.89 per barrel, so it was marked down by $460.00 in total. At the end of the year, he received tax information from the broker that showed a net profit from the trading of futures during the year of $6,773.46 (see Exhibit 9).

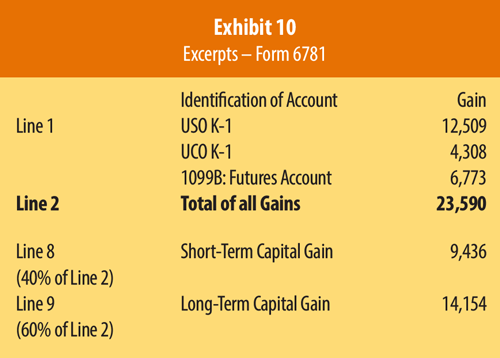

He combined this gain with his USO and UCO Section 1256 income and then entered these on Form 6781, Line 1. As the lead author completed the form, as expected, the results were 40% of the gain was to be treated as a short-term capital gain and the remaining 60% treated as a long-term capital gain. This treatment is consistent with Section 1256 of the tax code (see Exhibit 10).

The Dec. 23 Crude contract had a return of 25% ([$81.10-64.89]/64.89) for the first quarter of 2022. For the year end on March 31, 2022, the contract had a rate of return of 59.5% ([$81.10-50.84]/50.84)10. The lead author sold his Dec. 23 Crude contract on June 29, 2022 for $86.47 per barrel. His overall gain was $21,120.00, with -$460.00 recognized in 2021 and $21,580.00 recognized in 2022.

Oil and Gas Investment Options

In today’s world, who knows what will happen to the price of oil? The Russian invasion of Ukraine changed everything overnight. Someone has several options if they would like to invest directly into oil, rather than investing in an operating oil company. Several choices were examined in this article.

These investments can be risky, but they can also help favorably diversify a portfolio. For example, the past few months have seen many stocks go down by 20-30%, yet the lead author’s diversified portfolio has about broken even because of the enormous gains that he made with oil and gas investments.

The tax consequences of these investments are not so difficult that an investor should be scared away by them. Investors choosing to invest directly into oil should use caution and hope for good luck!

About the Authors

Arthur Young, Ph.D., CPA (retired), is an Associate Professor of Accounting (retired) in the College of Business at Tarleton State University. Contact him at Arthur.Young@retiree.tarleton.edu.

Debjeet Pradhan, Ph.D., is an Assistant Professor of Accounting in the College of Business at Tarleton State University. Contact him at pradhan@tarleton.edu.

Dennis Jones, Ed.D., is a Professor of Computer Information Systems in the College of Business at Tarleton State University. Contact him at djones@tarleton.edu.

Footnotes

1 U.S. Energy Information Administration. Renewable energy explained. https://www.eia.gov/energyexplained/renewable-sources. Accessed 26 Aug. 2022.

2 Yahoo Finance. BP Prudhoe Bay Royalty Trust (BPT). https://finance.yahoo.com/quote/BPT. Accessed 26 Aug. 2022.

3 BP Prudhoe Bay Royalty Trust. 10K, 2021 Annual Report (pp. 33-34). https://last10k.com/sec-filings/bpt. Accessed 26 Aug. 2022.

4 BP Prudhoe Bay Royalty Trust. 10K, 2020 Annual Report. https://last10k.com/sec-filings/bpt. Accessed 26 Aug. 2022.

5 Yahoo Finance. BP Prudhoe Bay Royalty Trust (BPT). https://finance.yahoo.com/quote/BPT. Accessed 26 Aug. 2022.

6 ProShares. ProShares Launches Only U.S. Crude Oil ETF With No K-1. 28 Sep. 2016, https://www.businesswire.com/news/home/20160928005852/en/ProShares-Launches-Only-U.S.-Crude-Oil-ETF-With-No-K-1. Accessed 26 Aug. 2022.

7 ProShares. OILK: K-1 Free Crude Oil Strategy ETF: Total Return (Quarter-Ended as of June 30, 2022). https://www.proshares.com/our-etfs/strategic/oilk. Accessed 26 Aug 2022.

8 ProShares. Ultra Bloomberg Crude Oil (UCO): Fund Fact Sheet. 31 Mar. 2022, https://www.proshares.com/globalassets/proshares/fact-sheet/prosharesfactsheetuco.pdf. Accessed 26 Aug. 2022.

9 ProShares. Ultra Bloomberg Crude Oil (UCO): Total Return (Quarter-Ended as of June 30, 2022). https://www.proshares.com/our-etfs/leveraged-and-inverse/uco/. Accessed 26 Aug. 2022.

10 Yahoo Finance. Crude Oil Dec 23 (CLZ23.NYM). https://finance.yahoo.com/quote/CLZ23.NYM/history/. Accessed 26 Aug. 2022.