May 10, 2024

SAS 143 - New Guidance on Auditor’s Responsibilities Relating to Accounting Estimates

By Steve Grice, Ph.D., CPA, and Amanda Paul, CPA

~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~

CPE Self Study Article & Quiz Register to gain access to the self-study quiz and earn one hour of continuing professional education credit by passing the quiz.

~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~

CPE Hours: 1

Curriculum: Accounting Technical

Level: Basic

Designed For: CPAs in public practice, management

Objectives: To explain and summarize the provisions of the Auditing Standards Board's Statement on Auditing Standards No. 143, which relate to the application of the current auditing guidance when estimates are involved in the engagement.

Key Topics: Examples of accounting estimates; understanding the entity and its environment; specialized skills and knowledge; assessing the risk of material misstatement (RMM); testing controls; management bias; reasonable estimates vs. misstatements; and required communications and documentation

Prerequisites: None

Advanced Preparation: None

~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~

In July 2020, the Auditing Standards Board issued Statement on Auditing Standards No. 143 entitled Auditing Accounting Estimates and Related Disclosures (SAS 143). The provisions of SAS 143 relate to the application of the current auditing guidance when estimates are involved in the engagement.

This new guidance supersedes AU-C Section 540, entitled Auditing Accounting Estimates, Including Fair Value Accounting Estimates, and Related Disclosures, and amends various other AU-C Sections. SAS 143 is effective for audits of financial statements for periods ending on or after December 15, 2023.

General Nature and Examples of Estimates

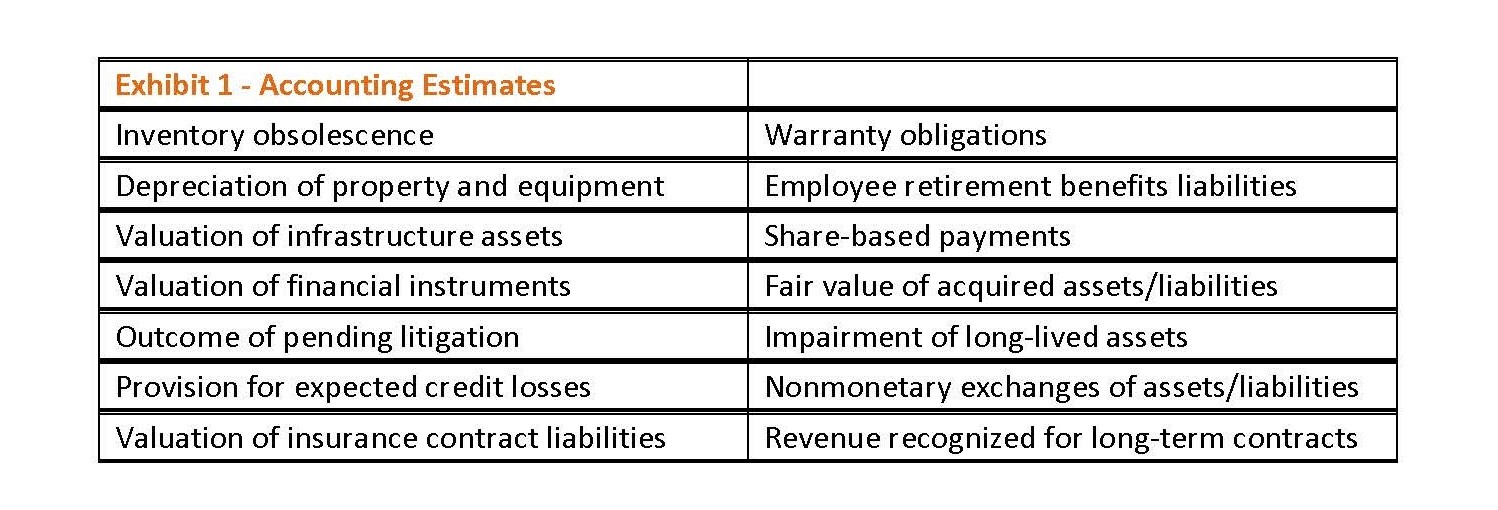

Estimates are necessary when monetary amounts that are required for financial reporting purposes are not directly observable. Estimates require the use of various estimation methods (e.g., the Black-Scholes option-pricing model) and may be highly subjective or highly complex. Exhibit 1 lists the examples of estimates shown in the application and other explanatory material in SAS 143.

AU-C Section 315, entitled Understanding the Entity and Its Environment and Assessing Risks of Material Misstatements, indicates that a risk of material misstatement (RMM) exists when there is a reasonable possibility of a material misstatement. A relevant assertion is defined as an assertion with an identified RMM before consideration of any related controls (i.e., based on inherent risk). For estimates, the susceptibility of an assertion to a misstatement may be affected by the following:

- Estimation uncertainty, which is the susceptibility to an inherent lack of precision in measurement. For example, the cost of a recognized amount cannot be precisely measured through direct observation.

- Inherent complexity in the process of determining the estimate before consideration of controls. For example, inherent complexity may arise when many assumptions are required to determine the estimate.

- Inherent subjectivity in the process of determining the estimate before consideration of controls. For example, there may be inherent subjectivity in the management’s selection of the appropriate valuation techniques.

- Other inherent risk factors such as changes resulting from events or conditions that affect management’s assumptions and judgments related to accounting estimates.

Understanding the Entity and Its Environment, Including Internal Control

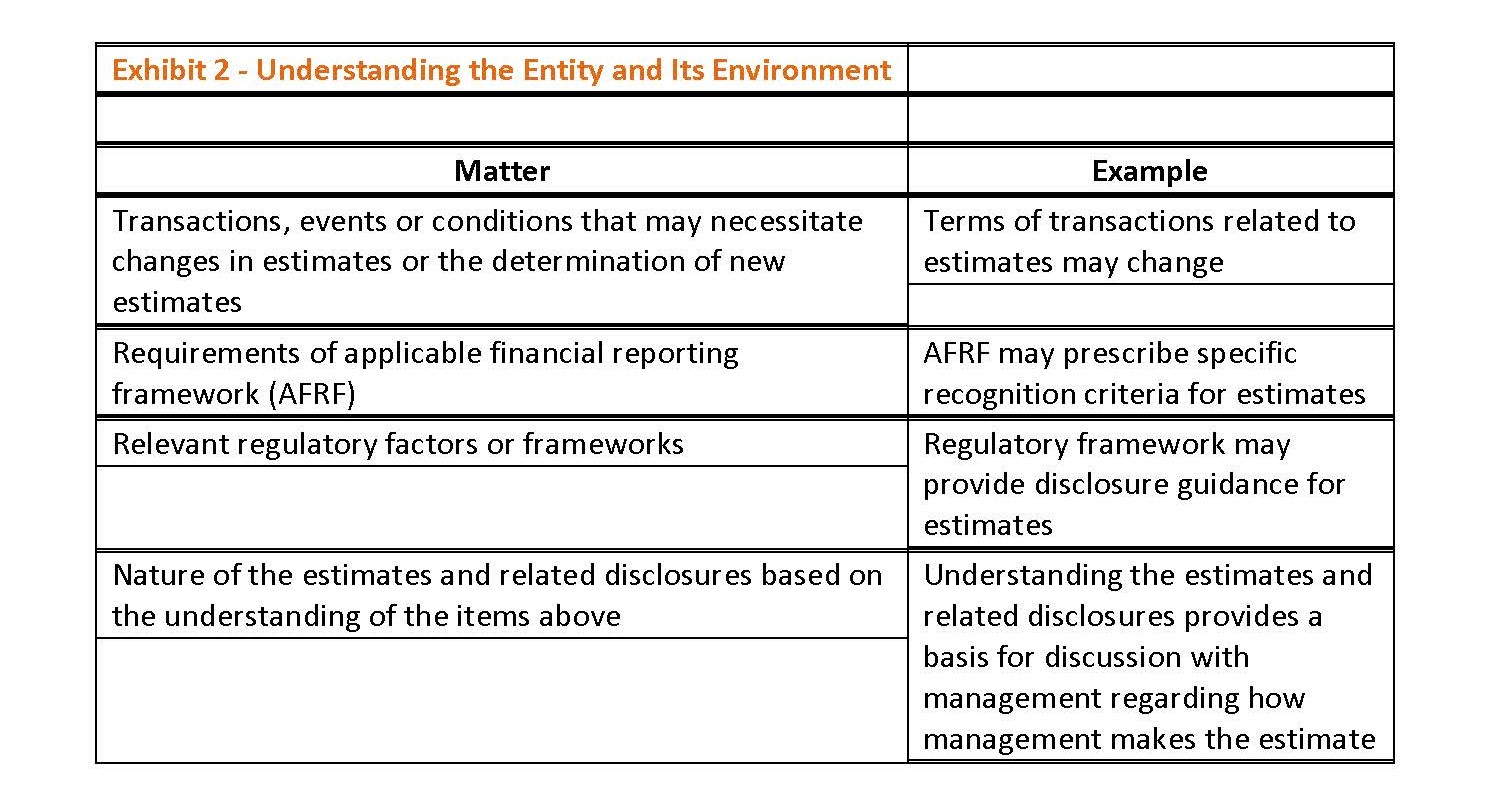

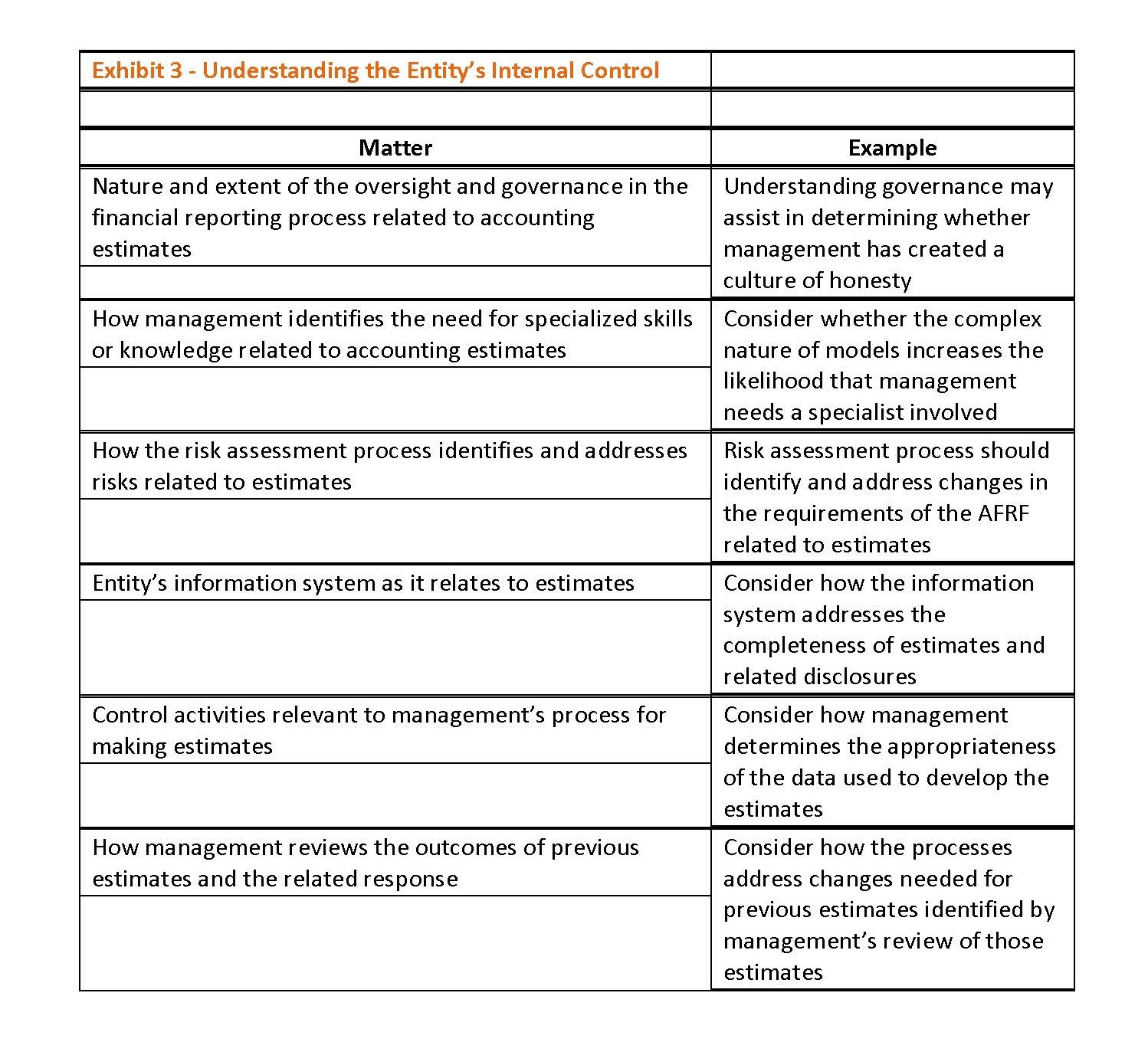

AU-C Section 315 requires the auditor to obtain an understanding of the entity and its environment, including internal control. SAS 143 indicates that the auditor should obtain an understanding of certain matters related to an entity’s estimates. Exhibit 2 provides a list of those matters (and examples) that should be included in the auditor’s understanding. SAS 143 also describes certain matters that should be included in the auditor’s understanding as it relates to the entity’s internal control. Exhibit 3 provides a list of those matters and related examples.

Previous Accounting Estimates

SAS 143 states that the auditor should perform a retrospective review, which is a review of the outcome of previous estimates (or the subsequent re-estimation). A retrospective review is not intended to call into question judgments about previous-period estimates, but rather to assist the auditor in identifying and assessing the RMM when previous estimates have an outcome in the current period (e.g., re-estimated for the current period). Other points related to the retrospective review discussed in the application and other explanatory material section of SAS 143 are as follows:

- A retrospective review may be performed for estimates in the prior period’s financial statements only, over several periods if deemed necessary (e.g., outcome of the estimate is resolved over a longer period) or a shorter period (e.g., semi-annual or quarterly).

- A retrospective review may be performed in conjunction with the review of significant estimates required by AU-C Section 240, entitled Consideration of Fraud in a Financial Statement Audit.

- The auditor may judge a more detailed retrospective review is required based on the auditor’s previous assessment of RMM (e.g., inherent risk assessed as high).

- The auditor may deem that the application of analytical procedures as a risk assessment procedure is sufficient for estimates that arise from routine/recurring transactions.

- For estimates that are based on current conditions at the measurement date (e.g., fair value estimates), the auditor may focus the review on obtaining information that may be relevant to identifying and assessing RMM. For example, audit evidence may be obtained by understanding the outcomes of certain assumptions such as cash flow projections.

- When a retrospective review reveals a difference between the outcome of an estimate and the amount recognized in the prior period’s financial statements, the auditor should consider whether the difference represents a misstatement. The difference may represent a misstatement if it arises from information that was available when the prior period’s financial statements were finalized. Additionally, the difference may cause the auditor to call into question management’s process of making the estimate (e.g., steps followed for gathering information when making the estimate).

Specialized Skills and Knowledge

In accordance with SAS 143, the auditor should determine whether the audit engagement team needs specialized skills or knowledge (SSK) to evaluate an estimate. SSK may be necessary to perform risk assessment procedures, to identify and assess the RMM, to design and perform audit procedures to respond to those risks, or to evaluate the audit evidence obtained.

The guidance also points out that many estimates do not require the use of SSK. For example, SSK may not be needed for an inventory obsolescence estimation but may be necessary for the calculation of expected credit losses for a financial institution.

SAS 143 lists several matters that may affect the auditor’s determination of whether SSK are warranted. For example, the nature of the accounting estimates for a certain industry (e.g., complex financial instruments) may affect the auditor’s determination. When a matter related to the estimate involves a field other than accounting or auditing, such as valuation skills, a specialist may be needed to assist the engagement team.

Identifying and Assessing the RMM

AU-C Section 315 requires the auditor to separately assess inherent risk and control risk for RMM relating to an estimate at the relevant assertion level. SAS 143 requires the auditor to take the following items into account when identifying the RMM and assessing inherent risk related to estimates recognized in the financial statements (including disclosures):

- The degree of estimation uncertainty that exists. For example, the accounting treatments require assumptions with long forecast periods that inherently have a high level of estimation uncertainty.

- The degree to which the selection and application of the method, assumptions and data are affected by complexity, subjectivity or other inherent risk factors. For example, the need for specialized skills by management may indicate that the estimation method is inherently complex.

- The degree to which the selection of management’s point estimate (i.e., the amount recognized or disclosed) is affected by complexity, subjectivity or other risk factors. For example, an estimate is more susceptible to misstatement due to management bias when that estimate is subject to a high degree of subjectivity.

In accordance with AU-C section 315, the auditor is required to determine whether any of the assessed RMM are significant risks. A significant risk is an assessed RMM for which the assessment of inherent risk is close to the upper end of the spectrum of inherent risk (e.g., high). For example, higher inherent risk may arise when there is complexity in data collection to support account balances. When the assessed RMM is a significant risk, the auditor must evaluate the design and implementation of the related controls.

Responding to the Assessed RMM

In accordance with AU-C Section 330, entitled Performing Audit Procedures in Response to Assessed Risks and Evaluating the Audit Evidence Obtained, the nature, timing and extent of further audit procedures should be based on the assessed RMM at the relevant assertion level. SAS 143 requires that the auditor’s further audit procedures include one or more of the following approaches.

One approach the auditor may include is to obtain audit evidence from events occurring up to the date of the auditor’s report. When using this approach, the auditor should evaluate whether such audit evidence is sufficient and appropriate to address the RMM relating to the estimate. For example, the sale of inventory shortly after the year-end may provide sufficient appropriate audit evidence. Alternatively, events occurring up to the date of the auditor’s report are unlikely to provide such evidence when the conditions relating to the estimate develop over an extended period.

Another approach the auditor may include is to test how management made the estimate. This approach may be appropriate when, for example, the auditor’s review of similar estimates in prior periods indicates that management’s current period process is appropriate. When using this approach, the procedures should be designed and performed to obtain sufficient appropriate audit evidence relating to:

- The selection and application of the methods, significant assumptions and data used in the estimation process.

- How management selected the point estimate and developed related disclosures about estimation uncertainty; note - the application and other explanatory material provide guidance to assist the auditor in this evaluation.

SAS 143 identifies numerous matters that the auditor’s further audit procedures should address related to methods, assumptions, data and management’s selection of a point estimate (including disclosures). For example, the procedures should address:

- Methods – The calculations are in accordance with the method and are mathematically accurate.

- Assumptions – Judgments made in selecting the significant assumptions give rise to indicators of possible management bias.

- Data – The data used is relevant and reliable in the circumstances.

- Selection of a point estimate – Management has taken appropriate steps to understand estimation uncertainty within the context of the AFRF.

The final approach the auditor may include in the procedures is to develop an auditor’s point estimate or range to evaluate management’s point estimate and related disclosures about estimation uncertainty. The procedures should include steps to evaluate whether the methods, assumptions or data used are appropriate within the context of the AFRF.

Similar to the approach to test how management made the accounting estimate, the procedures should be designed and performed to address the matters with respect to methods, assumptions, data and management’s selection of a point estimate (including disclosures) as discussed above. When the auditor develops an auditor’s range, SAS 143 states that auditor should:

- Determine that the range includes amounts supported by audit evidence and that have been evaluated to be reasonable in the context of the AFRF.

- Design and perform further audit procedures to obtain audit evidence regarding the assessed RMM relating to the disclosures that describe the estimation uncertainty.

Importantly, when the auditor uses the approach to test how management made the accounting estimate and concludes that management has not taken the appropriate steps to understand and address estimation uncertainty, the auditor is required to develop an auditor’s point estimate or range to the extent practicable.

SAS 143 indicates that the auditor should consider whether the auditor’s point estimate can be developed without impairing independence (i.e., without assuming management responsibilities).

Testing Controls

In accordance with AU-C Section 330, the auditor should design and perform tests of controls when (1) the auditor intends to rely on the operating effectiveness of the controls or (2) substantive procedures alone cannot provide sufficient appropriate audit evidence (e.g., management makes extensive use of information technology).

SAS 143 suggests that testing the operating effectiveness of relevant controls may be appropriate when inherent risk is assessed as higher on the spectrum of inherent risk. The guidance indicates that testing the operating effectiveness of controls related to highly complex estimates may be more useful than testing the operating effectiveness of controls related to highly subjective estimates. That is, the need for significant management judgment results in inherent limitations in the effectiveness and design of controls; thus, the auditor may focus more on substantive procedures.

SAS 143 requires that the auditor obtain more persuasive audit evidence as the reliance on the effectiveness of controls increases. Further, tests of controls are required in the current period when the auditor plans to rely on those controls for significant risks related to an estimate. AU-C Section 330 requires that the substantive procedures include test of details (e.g., recalculation to verify mathematical accuracy) when the auditor’s approach to a significant risk consists only of substantive procedures. Other examples of tests of details include examination and agreeing assumptions used in supporting documentation.

Other Considerations Relating to Audit Evidence

The auditor may need to evaluate the appropriateness of the work provided by a management’s specialist relating to estimates. SAS 143 suggests that one of the three approaches related to responding to assessed RMM previously discussed may be helpful to auditors when evaluating the appropriateness of the specialist’s work as audit evidence.

When the audit evidence has been prepared using the work of a specialist, AU-C 501, entitled Audit Evidence – Specific Considerations for Selected Items, requires the auditor to (1) evaluate the competence, capabilities and objectivity of the specialist, (2) obtain an understanding of the specialist’s work, and (3) evaluate the appropriateness of the specialist’s work.

SAS 143 discusses further audit procedures when external information sources are used when making the estimate. In general, the guidance indicates that the reliability of audit evidence increases when obtained from external sources.

The nature and extent of the procedures to consider the reliability of external sources may depend on a variety of factors. For example, when pricing-related data is from a single external source, the auditor may obtain similar data from an independent source for comparison. SAS 143 suggests that guidance in AU-C Section 402, entitled Audit Considerations Relating to an Entity Using a Service Organization, may be helpful when a service organization is used in making estimates.

Disclosures and Indicators of Possible Management Bias

In general, SAS 143 requires that the auditor design further audit procedures to obtain sufficient appropriate audit evidence regarding the assessed RMM at the relevant assertion level for disclosures related to an estimate. As previously discussed, the auditor’s further procedures may use an approach that tests how management made the accounting estimate or an approach where the auditor develops an auditor’s point estimate or range. Under both approaches, there are specific requirements related to disclosures about estimation uncertainty. Specifically, the auditor is required to:

- Address whether management has taken appropriate steps to address estimation uncertainty by selecting an appropriate point estimate and by developing related disclosures when testing how management made the estimate.

- Design and perform further audit procedures to obtain audit evidence regarding RMM to disclosures that describe the estimation uncertainty when the auditor develops an auditor’s range.

SAS 143 requires the auditor to evaluate whether indicators of possible management bias exist for estimates. For example, the auditor may judge that possible bias exists when management’s selection of a point estimate reveals a pattern of optimism (i.e., consistently trend toward favorable outcomes). When indicators of possible management bias exist, the auditor is required to evaluate the implications for the audit, such as further questioning management’s judgments. Management’s intention to mislead financial statement users is an indicator that is fraudulent in nature.

Considerations for Overall Evaluation

AU-C Section 330 requires that the auditor evaluate whether the assessments of the RMM remain appropriate prior to the conclusion of the audit. When applying this guidance to estimates, SAS 143 states that the auditor should evaluate whether:

- The assessments of the RMM remain appropriate, including when indicators of possible management bias exist. For example, the initial assessed RMM may have been based solely on the subjectivity involved in the estimate and further audit procedures subsequently identified a high degree of complexity. Thus, inherent risk may need to be reassessed at the higher end of the spectrum of inherent risk.

- Management’s decisions relating to the recognition, measurement, presentation and disclosure of the estimates are pursuant to the AFRF. For example, the auditor may evaluate whether the recognition criteria of the AFRF have been met.

- Sufficient appropriate audit evidence has been obtained. This evaluation should take into account all relevant audit evidence obtained, whether corroborative or contradictory.

Reasonable Estimates Versus Misstatements

SAS 143 requires the auditor to determine whether the estimates (and related disclosures) are reasonable in the context of the AFRF. Reasonable means that the requirements of the AFRF are appropriately applied, including those that relate to:

- The development of the estimate (e.g., methods and assumptions used).

- The selection of management’s point estimate.

- The disclosures about the estimate (e.g., disclosures that explain the nature, extent and source of estimation uncertainty).

SAS 143 describes three scenarios related to evaluating the reasonableness of management’s point estimates:

- When the auditor’s point estimate differs from management’s point estimate, this difference represents a misstatement.

- When the auditor’s range for the estimate does not include management’s point estimate, the misstatement is the difference between management’s point estimate and the nearest point in the auditor’s range.

- When the auditor’s range for the estimate is multiples of materiality, this may indicate that it is important for the auditor to reconsider whether there is sufficient appropriate audit evidence regarding the reasonableness of the amounts within the range.

The new guidance requires the auditor to evaluate whether management has included disclosures beyond those specifically required by the AFRF that are necessary to achieve the fair presentation of the financial statements. For example, the auditor may determine that additional disclosures are necessary when an estimate is subject to a higher degree of estimation uncertainty. Management’s failure to include such disclosures may lead the auditor to conclude that the financial statements are materially misstated.

Required Communications and Documentation

AU-C Section 260, entitled The Auditor’s Communication With Those Charged With Governance and AU-C 265, entitled Communicating Internal Control Related Matters Identified in an Audit, contain required communications with those charged with governance. SAS 143 requires the auditor to consider the matters to communicate related to estimates and take into account whether the reasons given to the RMM relate to estimation uncertainty or inherent risk factors (e.g., complexity or subjectivity) in making accounting estimates and related disclosures. For example, a significant deficiency in controls over the estimation process (e.g., selection and application of estimation methods) should be communicated to those charged with governance.

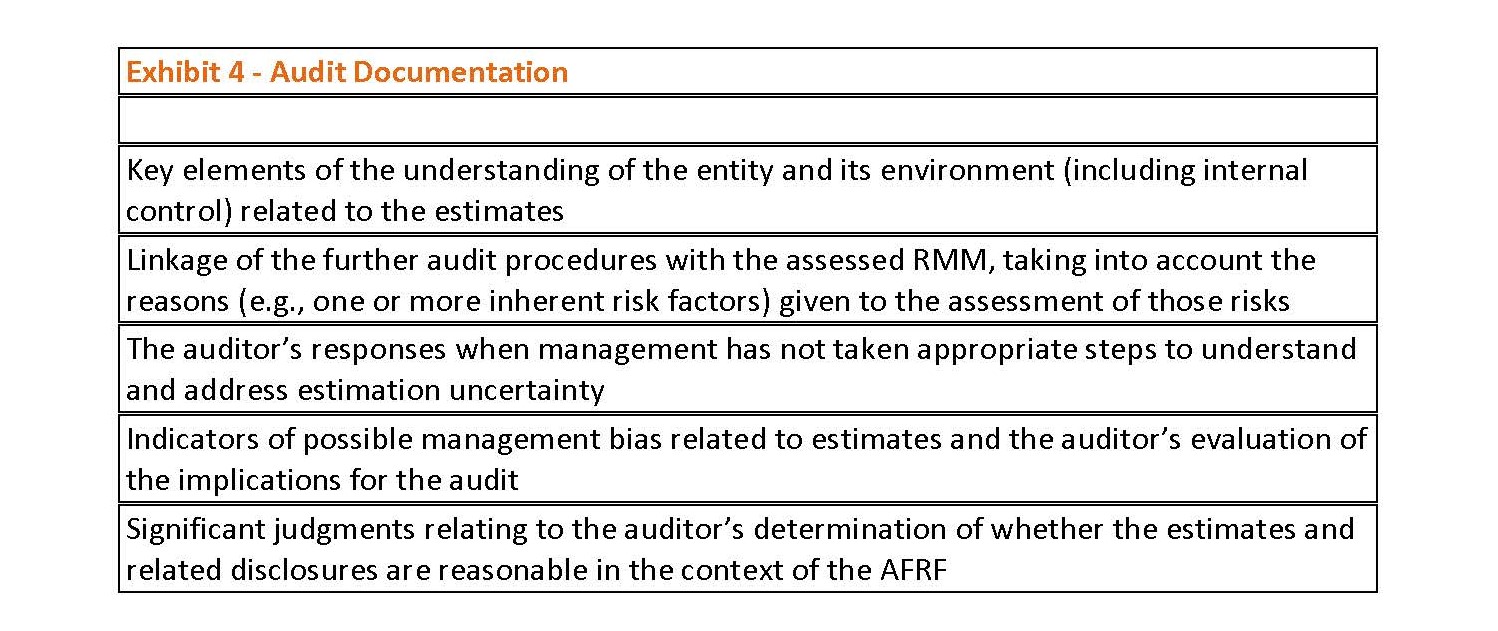

Exhibit 4 lists the items that should be included in the audit documentation related to estimates in accordance with SAS 143.

Review the Guidance

Hopefully, this overview of SAS 143 provides a better understanding of the auditor’s responsibilities relating to accounting estimates. SAS 143 includes extensive application and other explanatory material that can assist with implementation. Practitioners should carefully review the guidance in its entirety when implementing the provisions.

About the Authors:

Steve Grice, Ph.D., CPA, is Scholar-In-Residence at Troy University. Contact him at sgrice@troy.edu.

Amanda Paul, CPA, is Assistant Professor at Troy University.