May 13, 2024

TXCPA’s 2023-2024 Year in Review

By DeLynn Deakins, Today’s CPA Managing Editor

What a remarkable year it has been for TXCPA, your professional community! Under the leadership of our 20232024 Chair Tim Pike, CPA-Dallas, CFE, CGMA, TXCPA has worked to empower members to lead and succeed by offering a diverse range of professional resources, information and education opportunities. Additionally, we have remained steadfast in our commitment to defending and promoting the CPA profession.

Why Do You Belong?

TXCPA’s continuous member research helps us respond and offer what’s most important and valuable to our community. In 2023-2024, members told us the three most important reasons they belong to TXCPA are: (1) to protect their license, (2) for education, and (3) to stay up to date on professional issues. You’ll see that we aimed to provide additional value to members in all these areas and more in 2023-2024.

Protecting Your CPA License

The Texas Legislature convenes every other year, providing TXCPA with opportunities to prepare and focus on any priorities we want to pursue. Our three roles are to:

- Pursue legislative changes that would benefit the profession;

- Defend against legislative changes that would be detrimental to the profession; and

- Ensure we develop strong relationships with legislators and their staff teams to serve as a resource and have open lines of communication.

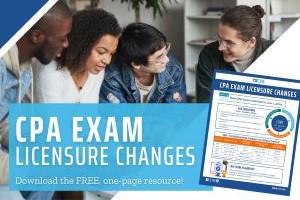

In the 2023 session, our advocacy efforts achieved significant successes in addressing critical issues affecting the CPA pipeline. Legislative wins included the passage of SB 159, enabling students to take the CPA Exam after completing 120 semester hours, and the expansion of the Texas State Board of Public Accountancy’s scholarship program through HB 2217. Post-legislative session, TXCPA remained actively engaged, providing input on State Board rules throughout the summer and fall of 2023. In November 2023, the State Board adopted permanent rules regarding SB 159 and eligibility criteria for taking the CPA Exam upon completion of 120 hours.

Working closely with the State Board, TXCPA proposed clarifications regarding the makeup of the 21 hours of upper-level accounting coursework needed to begin to take the Exam. These rule changes, along with other revisions made by the State Board, promise to enhance clarity regarding the educational pathway to testing and licensure for students and educators. The changes became effective in early 2024 commensurate with the new CPA Exam launching.

TXCPA supported and promoted the Applicant Reassessment Program, collaborating with the State Board, NASBA, AICPA and other state societies. This program aims to allow over 18,000 candidates nationally, including over 1,900 in Texas, to reenter the CPA testing regime if they faced hardships between 2020 and 2024. Approved applicants receive an additional 18 months to complete the Exam, providing a second chance for candidates who fell out of the pipeline for no fault of their own.

The Applicant Reassessment Program is currently operational in Texas. As of this writing, 142 applicants have had their Exam credits reinstated and 32 states have adopted a similar initiative known as the Credit Relief Initiative. TXCPA continues our collaboration with AICPA and other state societies to lobby for federal legislation regarding the CPA pipeline. A key issue gaining traction in Congress is the expansion of 529 plans to cover credentialing, testing and licensing expenses, in addition to traditional higher education costs. As of this writing, there are 128 co-sponsors in the House and 22 Senate co-sponsors.

In the federal regulatory front, there’s a key focus on Beneficial Ownership Information (BOI) under the Corporate Transparency Act, overseen by FinCEN. Significant concerns surround awareness of the requirement and the details required for filings. Our objectives are to:

- Continue to advocate for a delay in implementation;

- Raise awareness with members and the business community in general; and

- Serve as a resource for members as they navigate the issue.

We’ve been addressing this issue through the work of the Federal Tax Policy Committee (FTP). The FTP actively advocates for members by reviewing federal tax legislation, regulations and administrative pronouncements, providing essential feedback and representing your interests.

The FTP expressed concerns about BOI filing deadlines, urging a one-year extension until 2025 for all existing entities, making the 90-day deadline for new entities permanent and extending the reporting period for subsequent events to at least 90 days. In April, TXCPA, AICPA and other state CPA societies issued a letter to the Department of the Treasury and FinCEN expressing concerns that small businesses need more time to understand and comply with the rules. The Professional Standards Committee (PSC) also plays a crucial role for members and the profession by responding to matters of interest to the TXCPA membership. They review every professional standards exposure draft released. As of this writing, the PSC has issued eight comment letters during the 2023-2024 year.

Opportunities for Learning. At TXCPA, a top priority is delivering exceptional Continuing Professional Education (CPE). Our extensive selection of live and online courses allows members to customize their CPE experience. Programs this year covered hot topics, such as federal and state tax updates, BOI reporting, mergers and acquisitions, business management, AI and machine learning trends, emerging technologies, and more. Plus – your membership gives you access to a minimum of 20 hours of complimentary CPE! These sessions cover a variety of topics, including Texas taxes, ethics and other professional issues.

Opportunities for Learning. At TXCPA, a top priority is delivering exceptional Continuing Professional Education (CPE). Our extensive selection of live and online courses allows members to customize their CPE experience. Programs this year covered hot topics, such as federal and state tax updates, BOI reporting, mergers and acquisitions, business management, AI and machine learning trends, emerging technologies, and more. Plus – your membership gives you access to a minimum of 20 hours of complimentary CPE! These sessions cover a variety of topics, including Texas taxes, ethics and other professional issues.

Today’s CPA magazine also offers a one-hour self-study CPE opportunity. The online CPE quiz was revamped this year starting with the January/February issue and offers a fresh and immersive experience.

As of this writing, nearly 4,000 people have taken TXCPA learning programs this year.

Your Central Source of Information

TXCPA keeps members informed and educated about critical professional matters. TXCPA Chair Tim Pike visited several chapters over the last year and delivered Professional Issues Update presentations and other topics.

In addition, whenever significant developments occur, TXCPA promptly shares the latest insights and perspectives with the membership.

We refreshed the layout and design of Today’s CPA magazine, giving a publication with over a century of history a more modern and contemporary look and feel. TXCPA Exchange continued to thrive with ongoing member-to-member questions and discussions. Additionally, TXCPA maintains its connection and engagement with members through various communication platforms, including social media channels, webcasts, e-newsletters, the tx.cpa website, and more.

Growing the Pipeline of CPA Talent

Our commitment to expanding the CPA pipeline addresses challenges in talent recruitment and retention. We are in the second year of our CPA Pipeline Strategy. In addition to the legislative advocacy efforts discussed above, TXCPA focused on the following initiatives.

TXCPA President and CEO Jodi Ann Ray, CAE, represents your interests as part of the 22-member National Pipeline Advisory Group (NPAG). This group has been meeting since July 2023, and is scheduled to present a draft report and recommendations to AICPA Council in May.

In January, we launched our new podcast series, Destination CPA. Featuring conversations with leading voices across the profession, the podcasts provide insights and guidance for aspiring CPAs. You can subscribe on Apple, Spotify, Google or your preferred platform, and please share on social media to expand our reach.

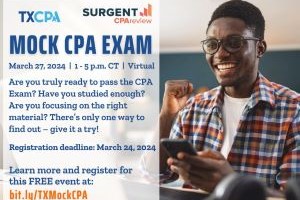

We created a new resource for students outlining CPA Exam changes and offered complimentary Mock CPA Exams in November and March. The Mock CPA Exam allows participants to simulate the Exam experience with questions pulled directly from the CPA Exam Blueprints.

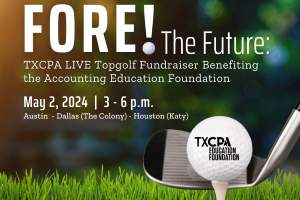

In May, we’re hosting “FORE! The Future,” an interactive statewide fundraising event at three Topgolf locations across Texas. Live simultaneous competitions will take place in Austin, Dallas and Houston.

Our Accounting Opportunities Months have been a great success. Partnering with 44 states and AICPA, we have taken a proactive approach to outreach. For the November Accounting Opportunities Month, 52 member volunteers visited 31 schools, reaching 1,741 students. As of this writing, a spring outreach is planned for April.

The Accounting Education Conference featured top speakers discussing trending topics relevant to educators and the profession’s future. This year, high school educators were invited to help spark student interest in pursuing accounting education and careers.

We continued and grew our successful faculty and student ambassador program, enhancing TXCPA’s presence on Texas campuses. You can learn more in the Be An Ambassador section of tx.cpa.

Connection to Your Professional Network and Community

As a member of TXCPA and your local chapter, you’re connected to a vast network of CPAs statewide. Each year, we organize our Month of Service event. Last November, 100% of TXCPA’s chapters participated, achieving a cohesive and collaborative public outreach.

Getting involved in a committee is a great way to maximize your TXCPA membership. With a range of committees available, there’s something to suit your personal and professional goals, as well as your time commitments.

We also expanded the programs available through the TXCPA Insurance Trust, offering insurance coverages tailored to professionals and their families. Enjoy exclusive rates from reputable carriers you know and trust.

TXCPA Communications. Between June 1, 2023, and March 28, 2024:

Exchange:

Total discussion posts across our four open communities (All Member Forum, Tax Issues, Non-Profit Accounting and CPA Practice Management): 2,237

Top 5 most searched terms: ERC, BOI, WISP, 1099, ERC Amended

Number of members who logged into Exchange at least once: 3,878

Number of TXCPA members who participated in Exchange discussions: 509

Facebook:

Total number of followers: 4,672; Number of followers gained: 139

X:

Total number of followers: 3,491; Number of followers gained: 48

LinkedIn:

Total number of followers: 8,408; Number of followers gained: 1,087

Instagram:

Total number of followers: 1,386; Number of followers gained: 128

What's Coming Up. Get ready for an exciting year ahead as we unveil our new Strategic Plan in 2024-2025. Also, mark your calendar now for TXCPA’s Annual Meeting of Members on June 28-29, 2024, at the Omni Frisco. Join us for a keynote by AICPA Chair Okorie Ramsey, CPA, CGMA, PMP, NACD.DC, and engage in shaping the future of TXCPA and your profession. Reserve your room now and we’ll see you there! Thank you for your membership and support of the many programs and services TXCPA offers. We can’t wait to see what we do together in 2024-2025.

What's Coming Up. Get ready for an exciting year ahead as we unveil our new Strategic Plan in 2024-2025. Also, mark your calendar now for TXCPA’s Annual Meeting of Members on June 28-29, 2024, at the Omni Frisco. Join us for a keynote by AICPA Chair Okorie Ramsey, CPA, CGMA, PMP, NACD.DC, and engage in shaping the future of TXCPA and your profession. Reserve your room now and we’ll see you there! Thank you for your membership and support of the many programs and services TXCPA offers. We can’t wait to see what we do together in 2024-2025.