July 01, 2024

Spotlight on Cyber Insurance

Cyber Insurance: What It Is, How It Works and Why You Need It

Every 40 seconds, a cyberattack occurs somewhere in the world. In the average time it takes to read this article, 10 to 15 attacks will have happened on global networks and servers. That equates to 2,220 global attacks per day, according to Security Magazine1. That’s more than 800,000 a year.

Not only is the frequency of attacks on the rise, so is the cost. IBM estimated the average global cost of a data breach to be $4.45 million2. That marked a 15% increase over three years.

The damage adds up quickly. Victims of cyberattacks incur many of the following expenses:

- Infrastructure damage;

- Incident communication to clients, employees and stakeholders;

- Identity restoration for impacted parties;

- Network interruption;

- Lost revenue;

- Inability to fulfill contracts;

- Security enhancements;

- Litigation costs and attorney fees;

- Regulatory penalties;

- Loss of intellectual property and clients;

- Ransom payments to hackers.

Big or Small, Hackers Attack All

The IBM report also noted the financial sector ranked second in sustaining damage from attacks. Only health care suffered more. Accounting Today reported a 300% increase in cyberattacks on accounting firms3 since the start of the COVID-19 pandemic in 2020.

Hackers target accounting firms of all sizes. The following incidents have occurred.

Last year, three of the Big Four accounting firms were among 500 targets of a global ransomware attack4. In November 2022, a Minnesota accounting firm with 270 employees suffered a breach5 that compromised Social Security numbers and other sensitive data. Last year, Accounting Today6 reported a malware attack on a small CPA firm in Georgia. An employee clicked a malicious link, encrypting the firm’s data. They paid a $450,000 ransom to recover their files.

Most small and medium-sized businesses could only survive for a week7 if they suffered a severe cyberattack. Accounting firms no longer have to assume all of the risk.

How Cyber Insurance Works

Cyber insurance, also known as cyber risk or cyber liability insurance, is a fairly new type of standalone policy covering losses from cyberattacks, including breaches or losses of confidential information.

Firms can recover some or all costs from a cyberattack, depending on the policy terms. This insurance requires regular premium payments, and firms can file a claim with the insurer if their network or digital assets are attacked.

A typical cyber insurance policy provides coverage in the following four key areas.

Incident Response covers the costs of dealing with a cyber incident, including forensic investigations, data recovery, legal advice, notification expenses, and public relations efforts.

Business Interruption aids businesses in recovering financial losses from cyber incidents that disrupt normal operations, such as ransomware attacks that shut down critical systems or data breaches causing downtime.

Cybercrime coverage protects businesses from financial losses due to cybercrimes, including social engineering scams, fraudulent wire transfers, funds transfer fraud, and extortion.

Privacy Liability helps businesses cover costs related to legal fees, settlements and damages resulting from data breaches or other privacy incidents that expose sensitive customer or employee information.

Standalone vs. Endorsements

Cyber coverage is often added as a rider to business or property insurance policies. However, these endorsements don’t offer the extensive protection and higher coverage limits of standalone cyber policies. A dedicated cyber insurance policy provides broader coverage for the risks CPAs face, including both first-party and third-party attacks.

First-party and Third-party Coverage

First-party attacks target an accounting firm’s network directly, while third-party attacks occur through another party, such as a client or vendor.

Cybercriminals are not unlike a run-of-the-mill burglar, who continuously searches for weak entry points. In the cyberworld where everything is connected by a network of wires, servers and clouds, a firm’s most vulnerable point is often a third party’s network.

Third-party coverage is crucial for CPAs, as hackers can use breached firm data to target clients, causing financial harm. This coverage helps with attorney costs to defend the firm, crisis management and public relations, settlement costs, court-ordered damages if the firm is found liable, regulatory inquiry responses, and government fines and penalties.

How Coverage is Underwritten

The higher the risk to the insurer, the higher the cost. Cyber insurance carriers evaluate risk based on the following factors.

Industry. High-risk industries like health care, legal and financial services are prime targets due to the sensitive data they store.

Company size. Larger companies have more network entry points.

Annual revenue. Higher revenue makes a company a bigger target for cybercriminals, especially for ransomware attacks. Revenue also indicates the potential financial impact of a breach.

Strength of security measures. Cyber insurance companies assess a company’s security measures, including:

- Enforcement of MFA, encryption, patch management, backups, email filtering, and endpoint protection;

- Secondary communication methods for validating fund transfers;

- Document retention and disposal policies;

- Access controls and password requirements;

- Security testing procedures;

- Effectiveness of employee cybersecurity training programs.

The Benefits of Buying Group Coverage

Due to rising risks and claims, cyber insurance premiums have surged. Purchasing coverage through a professional association like TXCPA can benefit members in a number of ways:

- Competitive pricing;

- Expert advice;

- Access to multiple carriers, including A+ rated insurers;

- Free, personalized risk assessments.

Click here to learn more about the TXCPA-endorsed cyber liability insurance plan.

A Vital Tool

Cyber insurance is a vital tool for accounting firms to protect themselves from the potential financial and reputational impacts of cyberattacks. Accounting firms should evaluate their cyber risk exposure, compare different cyber options and select the policy that best suits their needs and budget. By doing so, firms can enhance their cyber resilience, confidence and competitiveness in the digital age.

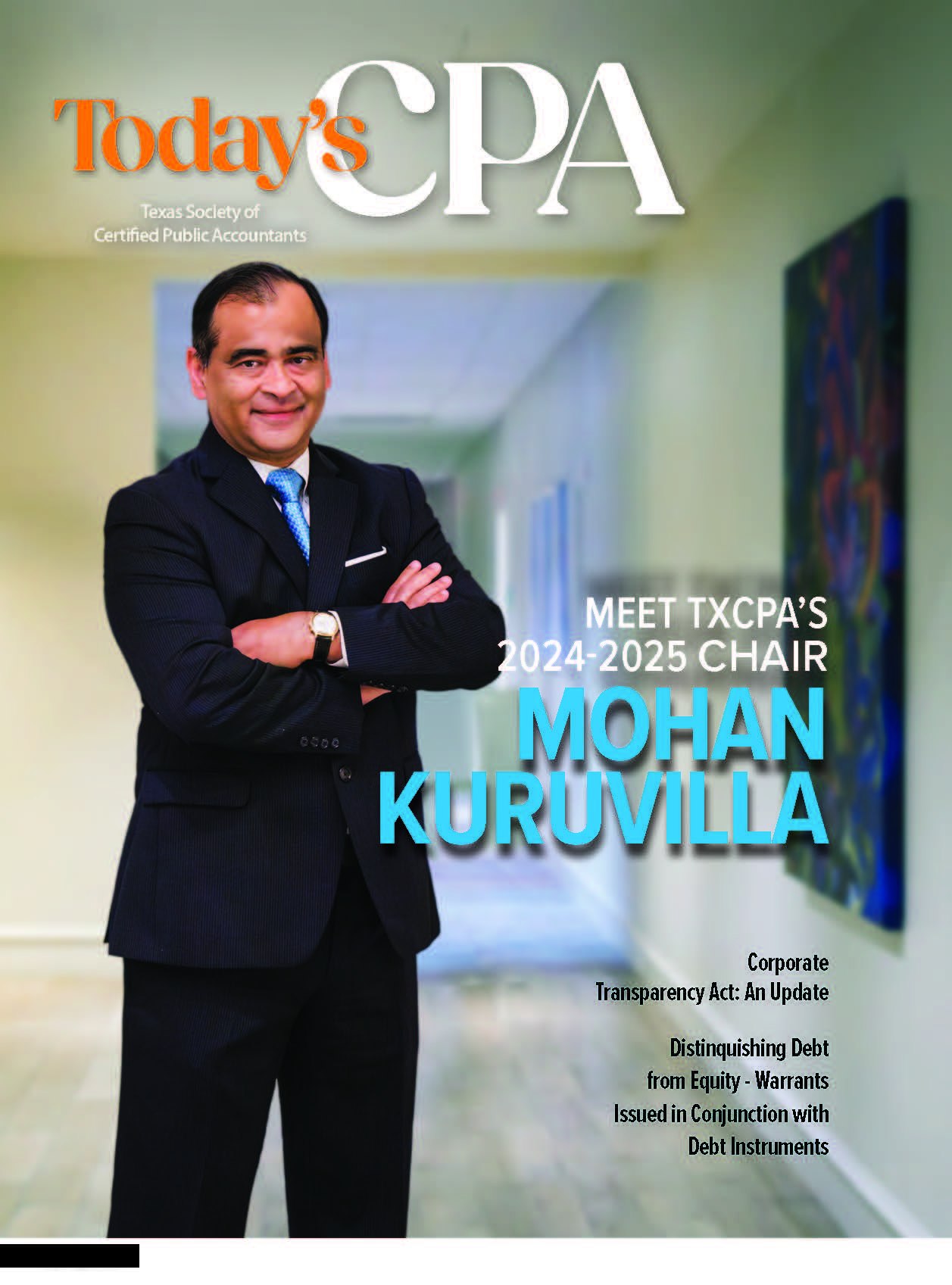

Why choose the TXCPA Member Insurance Program?

- Coverage designed for professionals and their families.

- Exclusive member rates from top-rated carriers.

- Your participation supports the mission of the Texas Society of CPAs.

- Learn more at txcpainsure.org or call us at 800-428-0272.

Protect What Matters Most with TXCPA Member Insurance

Safeguard your family, property and career with TXCPA Member Insurance. Our association-endorsed insurance offers value and reliability you can trust.

Footnotes

1. Fox, Jacob. “Top Cybersecurity Statistics for 2024.” Cobalt, Dec. 8, 2023. www.cobalt.io/blog/cybersecurity-statistics-2024

2. Cost of a Data Breach Report 2023. IBM, Overview Page. Referenced on May 9, 2024. www.ibm.com/reports/data-breach

3. Salman, Gary. “The rise of cybercrime in the accounting profession continues.” Accounting Today, Aug. 24, 2020. The rise of cybercrime in the accounting profession continues

4. Schappert, Stefanie. “Deloitte joins fellow Big Four MOVEit victims PWC, EY.” Cybernews, Nov. 15, 2023. https://cybernews.com/security/deloitte-big-four-moveit-pwc-ey-clop/

5. Phillips Erb, Kelly. “Big Four Accounting Firm Deloitte Confirms Cyber Attack. Forbes, Sept. 26, 2017.

6. Kelly, Sav. “Brady Martz & Associates faces four class-action complaints for 2022 data breach.” Grand Forks Herald, accessed from Yahoo!, Sept. 23, 2023.

7. Gaetano, Chris. “Cybersecurity for CPAs: One expensive click.” Accounting Today, April 12, 2023. www.accountingtoday.com/list/cybersecurity-for-cpas-one-expensive-click

Thanks to the Sponsors of Today's CPA Magazine

This content was made possible by the sponsors of this issue of Today's CPA Magazine: